The Dollar Drain*

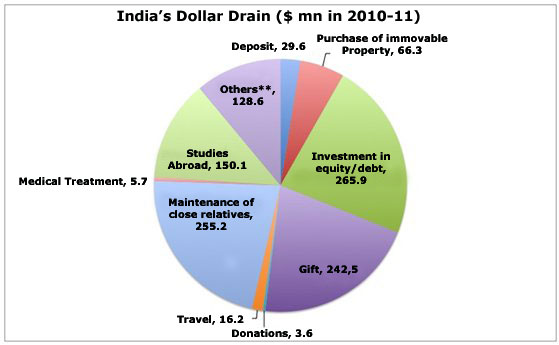

In recent years, well-to-do Indians have been sending foreign exchange abroad to acquire assets either directly or indirectly, through their relatives resident in foreign locations. In 2010-11, for example, Indian residents invested $266 million (around Rs. 1,300 crore) in equity abroad and bought immovable property worth $66 million. That aside they gifted money to or financed the expenditures of kith and kin abroad to the tune of around $500 million (Rs 2,500 crore) in that year. Add to this, remittances abroad for purposes such as studies, travel and medical treatment, and what is termed ''outward remittances by resident Indians'' by the Reserve Bank of India totalled $1.2 billion in 2010-11.

That might seem small relative to the magnitude of India's trade

and of capital inflows into the country. But it is a figure that

is rising. Estimated at $9.6 million in 2004-05 and $72.8 million

in 2006-07, the figure jumped to $440.5 million in 20007-08 and

has almost tripled itself by 2010-11.

The spurt in capital outflow was, of course, policy induced. In

February 2004 the government announced a new Liberalised Remittance

Scheme for Indian residents, marking a small but significant push

in the direction of full rupee convertibility. Under the Scheme,

resident individuals were permitted to convert rupees into foreign

exchange to acquire and hold immovable property or shares or debt

instruments or any other of a set of specified assets outside India,

without prior approval of the Reserve Bank. They were also permitted

for this purpose to open, maintain and hold foreign currency accounts

with banks outside India for carrying out transactions permitted

under the Scheme.

The scheme seems to have been motivated by the need to increase

demand for foreign exchange in the country, to exhaust a part of

the large flows of foreign capital that were finding their way to

India. But when the scheme was launched, the ceiling on transfer

for capital account purposes was set at $25,000 per person per calendar

year. Finding the flow inadequate for its purposes the government

hiked the ceiling to US $ 50,000 in December 2006 (per year) and

further to US $ 1,00,000 (per year) in May 2007. At that point,

remittances towards gift and donation by a resident individual as

well as investment in overseas companies were subsumed under the

scheme and included in the ceiling. This too proved insufficient

and the ceiling was raised just four months later in September 2007

to $200,000 per person per year. This implies that a family of five

would be permitted to transfer a total sum of a million dollars

a year under the heads of investments and gift. This is what has

resulted in the remittance trickle out of the country turning into

a significant drain.

Note that 2007-08 was the year when India was the target of a foreign

(fixed and portfolio) investment surge. Investment inflows rose

from a historical peak of $29.8 billion dollars in 2006-07 to $62.1

billion dollars in 2007-08. Along with this surge in capital inflows,

foreign currency assets with the Reserve Bank of India rose from

$192 billion on March 31, 2007 to $299 billion on March 31, 2008.

Very clearly the capital inflow surge was forcing the central bank

to buy up the surplus foreign exchange in the country, to prevent

excessive appreciation of the currency, since that was eroding the

competitiveness of India's exports. The result was that the RBI

was burdened with excess foreign reserves, and was therefore finding

it difficult to control money supply. Managing monetary policy and

the exchange rate at the same time was proving a problem. In response,

the government decided to stimulate demand for foreign exchange

from the private sector. To that end it hiked the right of the well-heeled

Indian to purchase foreign currency in India to acquire assets abroad.

India's rich responded leading to the sharp increase in remittances

to finance the acquisition of such assets.

Significantly, the four heads under which remittance outflows have

increased the most between 2006-07 and 2010-11 are: investment in

equity/debt (from $21 million to $266 million); gifts to close relatives

(from $7 million to $243 million); maintenance of close relatives

(from negligible amounts to $255 million); and, purchase of immovable

property (from $9 million to $66 million). Clearly there is a decision

being made here to sell domestic assets, convert domestic currency

into foreign exchange and hold assets abroad.

Fortunately for India, the global crisis of 2008 curtailed and then

moderated capital inflows and stabilised India's foreign currency

assets at lower levels. If not the liberalisation in policy may

have continued and the ceiling on outflows relaxed even further.

As a result the outflow surge may have been greater.

This emerging trend could change the perception of what constitutes

a foreign remittance in the vocabulary of an Indian. As of now,

when you speak of remittances in India, the image conjured is one

of the myriad Indians, skilled and unskilled, working as temporary

migrants and sending home a part of their earnings. Private transfers,

consisting largely of such remittances amounted to $53 billion in

2010-11. That was more or less exactly equal to the inflows on account

of exports of software services in that year. Given the hype surrounding

the software industry, it is clear that the short-run Indian migrant

is clearly an unsung hero in recent Indian development.

Compared to such figures the $1.2 billion of outward remittances

being discussed here is still miniscule. But the rising Indian appetite

to invest abroad could prove a problem if economic uncertainty increases,

especially uncertainty with regard to the rupee were to rise. Such

uncertainty could trigger capital flight in a liberalised environment.

Even if a tenth of the top one per cent of Indians enter the category

of households that can mobilise the equivalent of $200,000 a year,

the sum involved would be $240 billion. That is by no means small,

even relative to India's $260 billion reserve of foreign currency

assets, since much of that reserve is built with capital that has

the right to exit the country. India's elite may well choose to

economically secede from the country, precipitating a crisis in

the balance of payments.

*

This article was originally published in the Hindu on 7th April

2012 and is available at

http://www.thehindu.com/opinion/columns/Economy_Watch/article3290980.ece