The Roaring 2000s*

The

leaders of organised manufacturing in India complain much. About

intrusive government, inadequate economic reform, overly high taxation,

inflexible labour markets and much else. Even if there is an element

of truth in any or all of these, this does not seem to have affected

the sector's ability to garner higher profits in the years after

liberalisation. The sector seems to have done extremely well for

itself since the early 1990s.

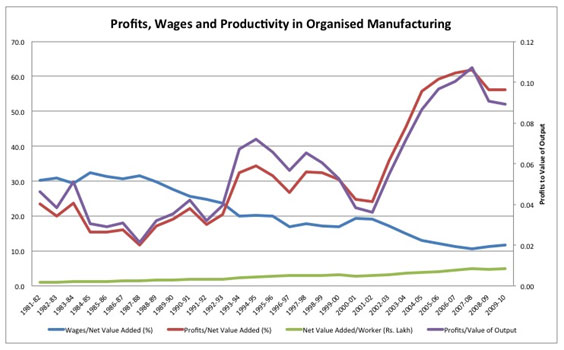

Consider trends emerging from the official Annual Survey of Industries

relating to the organised manufacturing sector depicted in the accompanying

chart.

To start with, since the early 1990s, when liberalisation opened

the doors to investment and permitted much freer import of technology

and equipment from abroad, productivity in organised manufacturing

has been almost continuously rising. Net value added (or the excess

of output values over input costs and depreciation) per employed

worker measured in constant 2004-05 prices (represented by the green

line), rose from a little over Rs. 1 lakh to more than Rs. 5 lakh.

That is, productivity as measured by net product per worker adjusted

for inflation registered a close to five-fold increase over this

30-year period. And more than three-fourths of that increase came

after the early 1990s.

Unfortunately for labour, and fortunately for capital, the benefit

of that productivity increase did not accrue to workers. The average

real wage paid per worker employed in the organised sector, calculated

by adjusting for inflation as measured by the Consumer Price Index

for Industrial Workers [CPI(IW) with 1982 as base], rose from Rs.

8467 a year in 1981-82 to Rs. 10777 in 1989-90 and then fluctuated

around that level till 2009-10. The net result of this stagnancy

in real wages after liberalisation is that the share of the wage

bill in net value added or net product (the blue line), which stood

at more than 30 per cent through the 1980s, declined subsequently

and fell to 11.6 per cent or close to a third of its 1980s level

by 2009-10.

A corollary of the decline in the share of wages in net value added

was of course a rise in the share of profits (red line). However,

the trend in the share of profits is far less regular than that

of the other components in net value added. Between 1981-82 and

1992-93, the ratio of profits to net value added fluctuated between

11.6 per cent and 23.4 per cent. During much of the next decade

(1992-93 to 2002-03) it remained at a significantly higher level,

fluctuating between 20.4 per cent and 34.3 per cent, but showed

clear signs of falling during the recession years 1998-99 to 2001-02.

However, the years after 2001-02 saw the ratio of profit to net

value added soar, from just 24.2 per cent to a peak of 61.8 per

cent in 2007-08. These were indeed the roaring 2000s! Unfortunately

for manufacturing capital, the good days seem to be at an end. There

are signs of the profit boom tapering off and even declining between

2006-07 and 2009-10. But this latter period being short, we need

to wait for more recent ASI figures to arrive at any firm conclusions.

As of now, what needs explaining is the remarkable boom in profits

at the expense of all other components of net value added. An interesting

feature that emerges from the chart is the fact that the ratio of

profits to value of output (violet line), or the margin on sales,

tracks closely the irregular trend in the share of profits in value

added described above. Increases in profit shares have clearly been

the result of a rise in the mark up represented by the profit margin

to sales ratio, or the ability of capital to extract more profit

from every unit of output.

Interestingly, the periods in which the ratio of profits to the

value of output has risen, leading to sharp increases in profit

shares, were also the years when the two post-liberalisation booms

in manufacturing occurred. The first of those was the mini-boom

of the mid-1990s, starting in 1993-94 and going on to 1997-98, which

was fuelled by the pent-up demand in the upper income groups for

a range of goods that had remained unsatisfied prior to the liberalisation

of imports and foreign investment rules. The second was the stronger

and more prolonged boom after 2002-03, led by new sources of demand,

which was arrested by the global financial crisis in 2008-09. The

coincidence of the profit and the output booms suggests that, in

periods of rising demand, the organised manufacturing sector in

India has been able to exploit liberalisation in two ways. First,

it has been able to expand and modernise using imported technologies,

raising labour productivity significantly in the process. Secondly,

it has been able to ensure that the benefit of that productivity

increase accrues almost solely to profit earners, because of the

conditions created by the ''reformed'' economic environment.

As a result, the mark up rose significantly or sharply in these

periods and delivered a profit boom. The evidence is clear. Big

industrial capital has been a major beneficiary of reform. Its complaints

are not to be taken too seriously.

*

This article was originally published in the Hindu, 10 May 2012,

and is available at

http://www.thehindu.com/opinion/columns/Chandrasekhar/article3403450.ece