Themes > Current Issues

29.09.2005

New Signs of Vulnerability

C.P. Chandrasekhar

Since

euphoria over the BSE Sensex breaching one more psychological barrier,

the 8000 mark, preoccupies the media, new signs of economic vulnerability

remain unflagged and ignored. According to the latest trade statistics

released by the Directorate General of Commercial Intelligence and Statistics

relating to the first five months of this financial year (April-August),

the deficit in India's merchandise trade stood at $17431.2 million as

compared with $9728.5 during the corresponding period of the previous

year. This 80 per cent increase in the deficit, if it persists over

the rest of the year, could take India's trade deficit to close to $50

billion over the financial year 2005-06.

It could be argued that such an increase was inevitable given the sharp

increase in the international prices of oil, which was and is expected

to substantially increase India's oil import bill. Indeed, over the

first five months of this financial year, oil imports rose in value

by close to 37 per cent, rising from $12002 million to $16428 million.

However, what is noteworthy is that over the same period non-oil imports

also rose by a similar 37 per cent from $26803 million to $37763 million.

In the event, despite a creditable 23 per cent increase in the dollar

value of India's exports during April-August 2005, the trade deficit

has widened substantially. Even if the increase in the oil import bill

is seen as temporary because oil prices must moderate and even fall,

the same cannot be said of the non-oil import bill. Clearly import liberalisation

has meant that any buoyancy in the economy, even if it is not focussed

on the commodity producing sectors, results in import bill increases

that match those generated by events like the current oil shock. If

that increase has to be moderated or reversed for any reason, lower

economic growth must be the price that has to be paid.

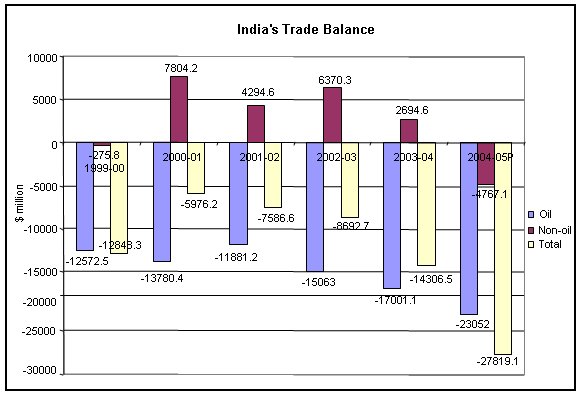

The full significance of this trend comes through when we note that

one comforting feature of India's balance of trade between 2000-01 and

2003-04 has been the surplus on the non-oil merchandise trade account

(see Chart). That surplus helped partially moderate the effects of a

rising oil trade deficit, which rose sharply between 2001-02 and 2004-05,

partly because of a gradual increase in oil prices and partly as a result

of dramatic increases in the domestic consumption of oil and oil products.

However, in 2004-05, the non-oil trade balance was once again negative,

removing the partial cushion offered by the trade in non-oil products

against the effects of a rising oil trade deficit at a time when the

rise in oil prices was sharper. What is happening is that, in a period

when oil prices have registered particularly sharp increases, the non-oil

import bill has kept pace with the oil import bill, resulting in a massive

widening of the deficit on the merchandise trade account.

It is of course true that even during the previous two financial years,

the widening deficit on the trade account was not a cause for concern

because of significant inflows of foreign exchange on account of remittances

and exports of software and IT-enabled serves. According to the Reserve

Bank of India, private transfers brought in a net amount of $20.5 billion

during 2004-05 and software services exports contributed another 16.6

billion dollars. This net inflow went a long way towards financing India's

foreign exchange requirement in that year on account of the merchandise

trade deficit and the deficit under other items of what are termed ''invisibles''.

As a result, the deficit on the current account of the balance of payments

was relatively small. Since India has also been a net recipient of substantial

capital inflows on account of debt and foreign direct and portfolio

investment, this led to a huge accumulation of foreign exchange reserves

that implied a comfortable balance of payments situation.

It now appears that India's relatively strong current account position

is weakening rapidly. As noted above a combination of rising oil prices

and dramatic increases in non-oil imports is resulting in a substantial

widening of the merchandise trade deficit. Simultaneously, there is

evidence that recent increases in remittance inflows are tapering off.

Net remittances, which rose from $16.4 billion in 2002-03 to $22.6 billion

in 2003-094, was down to $20.5 billion in 2004-05. While net revenues

from software services, continue their increase from $8.9 billion in

2002-03 to $11.8 billion in 003-04 and $16.6 billion in 2004-05, the

current account can be expected to widen because of the other two developments.

Consequently, a greater share of the net capital flows that India attracts

in the form of debt and foreign direct and portfolio investment would

now be needed to finance the current account deficit. This would be

perfectly acceptable if these capital inflows were being used to build

productive capacities that can support exports and earn the foreign

exchange needed to meet future foreign repayment commitments that today's

inflows imply. That, however, is clearly not happening. Portfolio flows

create no additional capacities, though FII investments drive the current

stock market boom and create the euphoria that explains the lack of

concern about potential external vulnerability. And to the extent that

foreign debt and direct investment inflows are indeed creating new capacities,

they are not generating export revenues to finance the rising non-oil

and oil import bill.

This is not surprising. It has been clear for some time now that unlike

what occurred in the late 1980s and early 1990s in second-tier East

Asian industrialisers like Thailand and Malaysia, and very much unlike

what has been happening in China for close to a decade-and-a-half now,

''non-financial'' investments financed with foreign capital in India

have not been directed at greenfield projects that contribute to an

expansion of exports. Rather, they have principally been: (i) directed

at increasing the share of foreigners in firms they already control

consequent to the relaxation of ceilings on foreign holdings in domestic

joint ventures catering to the domestic market; (ii) used for acquisitions

of local firms that provide foreign investors with a share in the domestic

market for a range of products; and (iii) concentrated in greenfield

projects in infrastructural services such as power and telecommunications,

which in any case are sectors that produce ''non-tradables'', or services

that are not normally exported to foreign markets.

The only area in which an increase in foreign presence involves export

revenues as a rule is the software and IT-enabled services sector. But

even though export revenues from this sector have been rising rapidly,

the sector is still too small to make up for the foreign exchange profligacy

of the rest of the economy. Overall import liberalisation, combined

with a concentration of incomes in sections of the population with a

significant pent-up demand for imported or import-intensive goods, has

resulted in an excess of demand for foreign exchange relative to current

account earnings.

The incipient tendency towards external vulnerability that this entails

has thus far been ignored for two reasons. First, India's exports have

been performing better in recent years than they did in the past. Second,

India has been such an attractive destination for foreign financial

investors that inadequacy of foreign exchange has become a feature of

a rarely remembered past.

Other than for 2001-02, when India's exports declined marginally, exports

in dollar terms have been rising at over 20 per cent an annum over most

years of this decade. This has been the focus of statements by Commerce

Ministry spokespersons. As and when any reference is made to import

growth, a rise in the import bill is presented more as evidence of recovery

in the industrial sector, rather than as a cause for concern because

that rate has implications for the merchandise trade deficit.

Implicit in this view is the belief that a trade deficit does not matter,

since invisible revenues ensure that a rise in the trade deficit does

not automatically translate into a rise in the current account deficit

and that, even if it does, capital flows are more than adequate to cover

the likely increase in the current account deficit. Recent experience

has shown that the import surge is such that even with reasonable export

growth this view is no longer true. What is more, periodic currency

crises elsewhere in the world suggest that reliance on purely hot money

flows to finance such a current account deficit is by no means a sensible

strategy.

But there is a more fundamental problem here. The success of any liberalisation

strategy depends in the final analysis on the realisation of a rate

of export growth that can deliver growth without balance of payments

problems that are structural. This makes comparisons of the rate of

export growth over time meaningless. Allowing for a reasonable lag,

what is needed is a rate of export growth at any point of time that

covers the increase in imports that liberalisation involves as well

generates the revenues needed to meet commitments associated with capital

inflows. It would be absurd to use more capital inflows to cover past

capital flow commitments, since this involves a spiral of dependence

on capital inflows. Such dependence implies even greater fragility if

such capital flows are of a kind that are footloose and investors can

exit the country with as much enthusiasm as they showed when they entered.

What the evidence on India's trade trends suggest is that even as dependence

on volatile capital flows increases, an export growth rate that is presented

as creditable appears increasingly adequate to cover the import surge

in non-oil imports. Add on a surge in the oil import bill and that inadequacy

is all the greater. This implies that the dependence on volatile flows

to sustain the balance of payments is rising. If the current boom in

the stock market reaches its inevitable peak, then not only will new

capital flows dry up but past capital flows would seek to exit the country.

That is a denouement that must be avoided if India is not to follow

the example of ''emerging markets'' like Mexico, South Korea, Thailand,

Indonesia, Malaysia, Brazil, Turkey and Argentina. If it does, then

it could be the next case where a financial crisis can be the means

to ensure neo-colonial conquest of a country whose elite sees itself

as populating a rising global power.

© MACROSCAN 2005