Themes > Current Issues

01.09.2009

Who Needs these Taxes?

C.P. Chandrasekhar

It is

not just a revamp, claims the government, but altogether new. After

many rounds of reduction of the marginal tax rate and years of tinkering

with the structure of direct taxes it claims to have decided to drastically

alter the direct tax regime. To that end it has launched a debate

that would lead up to the introduction of legislation to put in place

a new direct tax code. The discussion paper accompanying the draft

code attempts to draw attention to a number of features of the new

code: the definition of income, clarity regarding who can be taxed

and the treatment of exemptions. But discussion on the code is likely

to be dominated by the extent of taxation of personal and corporate

incomes that the new regime would involve.

In this regard there is one aspect of the new code that is welcome.

It seeks to rationalize the innumerable tax exemptions given to both

high-income personal income tax payers and corporations. The consequence

of this would be enhanced revenue generation and a greater degree

of transparency in the tax structure. It would also possibly lead

to greater equity, since most tax exemptions are either directed at

or more easily exploited by those in higher income tax brackets.

Budget documents for 2009-10 estimate that the “tax expenditures”

on account of foregone taxes during 2008-09 amounted to Rs. 68,914

crore in the case of corporate taxes, Rs. 5116 crore in the case of

non-corporate (partnerships, associations of persons, bodies of individuals)

tax payers and Rs. 34,437 crore in the case of income taxes. This

amounts to around 17 per cent of the gross tax revenues which accrued

to the central government according to the revised estimates for that

year. Recouping a significant share of this would make a considerable

difference to the budgetary position of the government and increase

its fiscal manoeuvrability.

However, if this and greater transparency and equity were the objectives

that the government was pursuing then a revamp of the existing tax

law to get rid of a wide range of unnecessary exemptions would have

been adequate. That the government is pursuing objectives other than

these is clear from its unorthodox decision to include in the documents

for discussion on the proposed Direct Tax Bill a proposal for a new

structure of direct tax rates. That structure could lead to a sharp

reduction of taxes currently paid by individuals and corporates in

different tax brackets under the present tax regime.

The way this is to be ensured is a significant widening of the tax

slabs leading to a situation where individuals would pay only 10 per

cent tax as long as they remain in the slab Rs.1,60,000 to Rs. 10,00,000,

20 per cent in the slab Rs.10,00,000 to Rs. 25,00,000 and 30 per cent

thereafter. Further, the corporate tax rate is to be reduced from

30 per cent to 25 per cent and the minimum alternate tax (MAT) is

to be calculated on the value of gross assets, 2 per cent of which

will have to be paid at the minimum by all non-banking companies.

Currently, the income tax payer pays 10 per cent tax on income between

Rs. 1.6 lakh and Rs. 3 lakh, 20 per cent between Rs. 3 lakh and Rs.

5 lakh, and 30 per cent beyond Rs. 5 lakh. This means, for example

that an individual who earns a lakh of rupees every month by way of

taxable salary will see a substantial reduction in the amount of income

tax paid. Moreover, the ceiling on tax-free acquisition of savings

instruments has been increased from Rs.1 lakh to Rs. 3 lakh, even

though the range of instruments eligible for that concession has been

reduced.

By specifying these rates and ranges, even while indicating that they

are also subject to discussion, clearly ties the hand of the government.

Taxes, which are increasingly seen as “hurting” the tax payer and

not as financing beneficial public provision, are such that once the

government proposes a level it can go downwards from there but not

upwards without opposition. This implies that the government has chosen

to significantly cut rates by widening tax slabs and adjusting the

number of rates.

The government’s own view is that such comparisons between the proposed

direct tax regime and the existing one are not valid, because what

we have is a structural transformation in regime. One way of interpreting

that statement could be that it is implicitly declaring that the potential

reduction in revenues as a result of wider slabs and lower rates would

be more than neutralised by the reduction in exemptions under the

proposed regime and by the increased compliance that a lighter tax

regime would encourage. For example salaries in the private sector

are expected to be computed on a cost-to-company basis and the imputed

rental value of rent free accommodation (for example) is to be treated

as part of the salary.

The danger here as can be seen even in the early responses to the

draft code is that the debate in the run up to legislative action

would force the restoration of a range of exemptions while sticking

with the proposed new slabs and rates. Moreover, monitoring whether

value of perquisites are actually computed and included in salary

would be difficult and evasion through such exclusion can be as much

or higher than in the case of evasion of post-exemption income and

tax calculations. The expected quid-pro-quo may not materialise and

revenues may in fact decline.

Given this, the belief that the new code would contribute to an increase

in tax collections is largely based on the faith that reduced tax

rates would contribute to better compliance. Needless to say, this

faith in the “Laffer curve” is neither theoretically nor empirically

grounded. In the event, the new tax code is ill-advised for at least

two reasons. The first is that it comes at a time when despite the

consensus that public capital formation and public expenditure on

social infrastructure and social protection are grossly inadequate

in India, the deficit in the budget of the central government is rising.

Even though there are expectations that the deceleration in growth

in India induced by the global crisis is hitting bottom, there is

substantial agreement that the government must keep expenditure high

if the rate of growth is not to slump further. This would lead to

inflation if it is financed by borrowing rather than by a draft on

private savings through taxation given the fact that food price inflation

is already high and a truant monsoon is likely to intensify supply

constraints. This then is the least propitious time to launch an adventurous

experiment in resource mobilisation involving a cut in direct tax

rates.

But the case against the code is not just short term. It would also

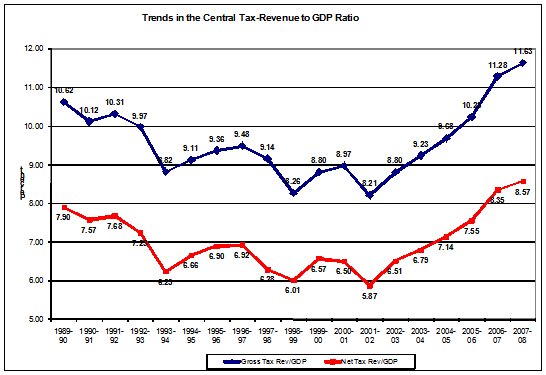

abort the much-needed correction of the decline and stagnation of

the tax-GDP ratio at the centre. One striking feature of the 1990s,

which was the first decade of accelerated economic reform, is that

despite evidence of reasonably good growth rates and signs of growing

inequality, there was no improvement in the Centre’s ability to garner

a larger share of resources to finance expenditures it considered

crucial. Even when corporate profits and managerial salaries were

reported to be rising sharply, taxes did not appear as buoyant. The

Central tax GDP ratios in India were declining for much of this period.

And despite the increase in the ratio in recent years, they exceeded

the level they were at in 1989-90 only in 2006-07 (Chart ). Despite

high growth, improved profitability and signs of increased inequality

(which should improve tax collection), the increase has been adequate

to just about put the tax GDP ratio back to its immediate pre-liberalisation

levels. Thus an effort to raise this ratio even further is what is

called for.

If these imperatives have been ignored in the new code it must be

because of the view that households taxed lightly would increase their

consumption and firms taxed lightly would invest more, and enhance

consumption and investment would drive growth. There are three problems

with this argument. First, it underestimates the role that public

expenditure in general and public capital formation in particular

plays in crowding in private investment, as amply illustrated by past

Indian experience. Second, it privileges GDP growth even at the cost

of reducing the role of direct taxation in moderating the inequalising

character of recent economic growth. Finally, it completely ignores

the important role of tax-financed public expenditure in alleviating

poverty, providing social protection and advancing human development.

The tax code is a signal that UPA II plans to continue with the policy

of cajoling private capital into investing for growth with concessions

that have adverse equity and welfare implications.

© MACROSCAN 2009