Themes > Features

17.04.2012

Factor Shares in the Indian Economy*

Discussions

of income distribution in the Indian economy tend to be almost entirely

based on data relating to consumption distribution, which is typically

used as a proxy for income distribution. This is largely because the

only large and reasonably periodic (though still not annual) datasets

available are the NSSO Surveys of household consumption, which are also

useful because they allow disaggregation of households along various

other criteria such as location, household characteristics, employment

status and so on. Even so, the exclusive reliance on household consumption

data is necessarily a limitation.

For several reasons, this approach tends to understate the extent of

inequality. Firstly, it is well known that the nature of the surveys

is such that they tend to underestimate the tails of the distribution,

excluding the very rich and the very poor. Secondly, and possibly more

importantly, consumption covers only a part (albeit a large part) of

income, and it is also well known that the poor are more likely to consume

as much or even more than their income while the rich are more able

to save. So income distribution is more unequal than consumption distribution.

Indeed, focusing only on consumption distribution not only understates

the extent of inequality but also may not help in capturing changing

trends, particularly if these changes are reflected more in savings

than in consumption.

There is another way of looking at distribution, which reflects the

position of agents in the economy and identifies them as employers,

workers, those receiving “mixed incomes” typically because of self-employment,

and those receiving incomes from financial investments. This is in many

ways the more economically illuminating way of looking at distribution

in an economy.

The classical economists Smith, Ricardo and Marx all recognised that

the most significant issues with respect to distribution related to

the distribution of power and income among the classes, defined by their

ownership of or relation to the means of production. This in turn affects

many macroeconomic variables: the rates of saving and investment, patterns

of accumulation, the nature of the growth process, and so on. In the

Indian case, examining the behaviour of factor shares provides important

insights into both the underlying forces of the current growth process

and the implications of aggregate income growth for the conditions of

workers and self-employed persons.

An earlier study by Sandesara and Bishnoi (“Factor Income Shares by

Sectors in Indian Economy, 1960-61-1981-82: A Statistical Analysis”,

Economic and Political Weekly, 9 August 1986) found that in the decades

of the 1960s and 1970s, there had been a significant increase in the

share of compensation of employees, from 35 per cent of total income

to 41 per cent. They also found declines in the mixed income of the

self-employed. They associated both of these tendencies with the structural

changes associated with growth and development, and saw them as fairly

typically processes of the gradual transformation and diversification

of the Indian economy.

However,

an analysis of the data for the subsequent period after 1980 throws

up very different results. It is worth noting that this period after

which the Indian economy is generally seen to have “taken off” in terms

of transcending the “Hindu rate of growth” to move to a higher growth

trajectory, has been one in which these tendencies have been less marked

or even reversed.

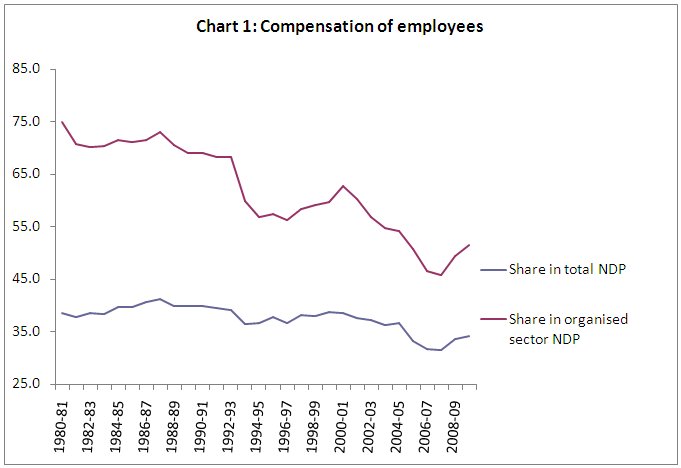

The following charts show data calculated from the CSO's statistics

on factor incomes for the period 1980-81 to 2009-10. All the data refer

to current price variables. Chart 1 shows that in terms of overall NDP,

there has been a slight and slightly uneven decline in the share of

compensation of employees, more marked especially in the most recent

years. However, within organised sector NDP, the decline is much sharper

and even quite striking, with the share falling from 75 per cent in

1980-81 to 69 per cent in 1990-91 to 60 per cent at the turn of the

century to as low as 46 per cent in the late 2000s, recovering slightly

to 51 per cent in the most recent year, 2009-10.

Until

2000, the CS0 provided data separately for operating surpluses and mixed

incomes (typically received by the self-employed). However, for the

past decade this distinction has no longer been maintained and therefore

it is no longer possible to estimate how the two have moved individually

for the period after 2000-01.

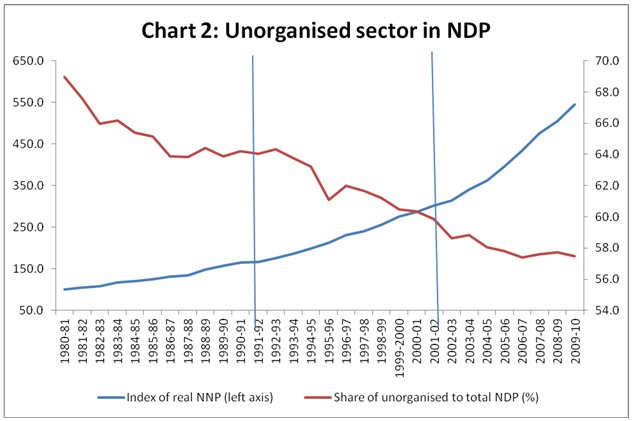

However, another important process in the past three decades is easy

to identify: the decline in the share of the unorganised sector in GDP.

This is part of a longer term trend also identified by Sandesara and

Rao for the the previous two decades. They noted that the unorganised

sector's share of GDP declined from 74 per cent in 1960-61 to 66 per

cent in 1980-81. As evident from Chart 2, the decline in share continued

in the subsequent decades, though somewhat moderated in the first part

of the period, and experienced a much sharper fall in the later period.

It is possible to link this with the growth of national income, as the

period of most rapid acceleration of NNP was also the period of sharpest

fall in the share of unorganised incomes. This is obviously a process

to be welcomed as it is evidence of desired structural change. The concern

is however, that it has been accomapnied by no increase (and even a

slight decrease according to the NSSO data) of the organised sector's

share in total employment. Thus, unorganised employment accounts for

the overwhelmingly dominant share (more than 95 per cent) of all workers,

even through the recent period of rapid growth when its the share of

national income has been falling sharply.

From Chart 2 it is also possible to conceive of dividing this thirty

year period into three distinct phases. The first break is clearly 1991-92,

which marked the start of the phase of liberalisation, the market-oriented

reform process in the Indian economy. This did not mark a major acceleration

of the growth of national income, which remained at approximately the

same rate for the next decade (as evident also from Chart 3). The second

break is 2001-02, not because of any major policy regime change, but

because this was indeed a different period in terms of growth aceleration.

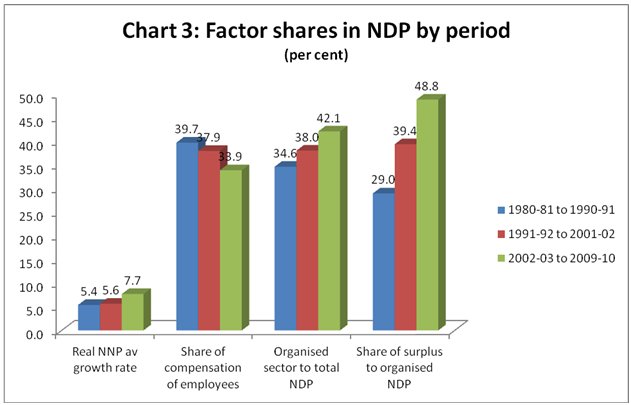

Chart 3 confirms that compared to around 5.5 per cent average annual

growth of national product in the first two period, the third period

showed a jump to an average annual rate of 7.7 per cent. The subsequent

bars in the chart indicate avaerages of share of NDP in each of the

three periods.

What emerges is that the period of growth acceleration was also the

period of significant decline in the share of compensation of employees

in aggregate NDP, from an average of 38 per cent in the previous period

to less than 34 per cent. Meanwhile, the share of the organised sector

continued to show substantial increases. But what is most notable is

the very significant increase within the organised sector's NDP, of

the share of surplus. It now accounts for nearly half of the income

accuring to that sector, a massive increase over three decades.

Clearly, in the period of rapid growth, that growth has been focussed

on the organised sector in GDP terms (though unfortunately not in employment)

and the greater part of the growth has accrued to the surplus-takers.

This confirms the reality that is increasingly apparent within Indian

society, of a growth process that has generated significant economic

inequality and concentrated the gains among those who do not have to

work as employees in the organised sector or as self-employed workers

in the unorganised sector.

*This

article was originally published in the Business Line on 2nd April,

2012

©

MACROSCAN 2012