Themes > Features

10.02.2009

The Asian Face of the Global Recession

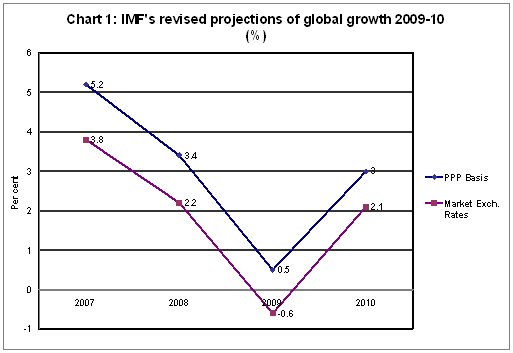

Delegates to the World Economic Forum at Davos this year came despondent and left in despair. Both the discussions and the new evidence released at and during the Forum indicated that the global crisis was not just bad, but worse than originally anticipated. One damaging projection came from the IMF in its January 2009 Update to the World Economic Outlook, which declared: ''Global growth in 2009 is expected to fall to half percent when measured in terms of purchasing power parity and to turn negative when measured in terms of market exchange rates. This represents a downward revision of about 1¾ percentage point from the November 2008 WEO Update.'' (Chart 1)

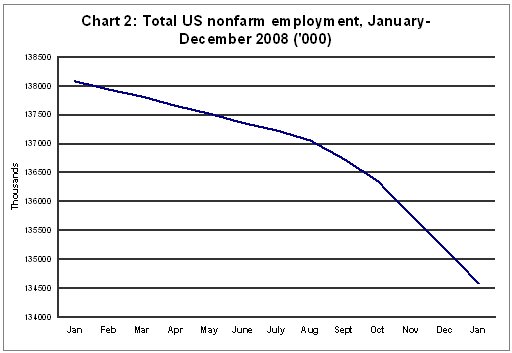

Moreover,

data released in recent months by the US Bureau of Labour Statistics

points to a sharp fall in non-farm employment in the US in recent months

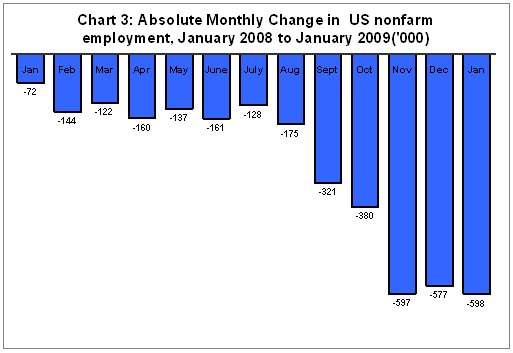

(Chart 2). The monthly decline in nonfarm payroll employment touched

598,000 in January when the unemployment rate rose from 7.2 to 7.6 percent.

Nonfarm employment has declined by 3.6 million since the start of the

recession in December 2007, and about a half of this decline occurred

in the past 3 months (Chart 3). The impact this would have on demand

would only aggravate the recession.

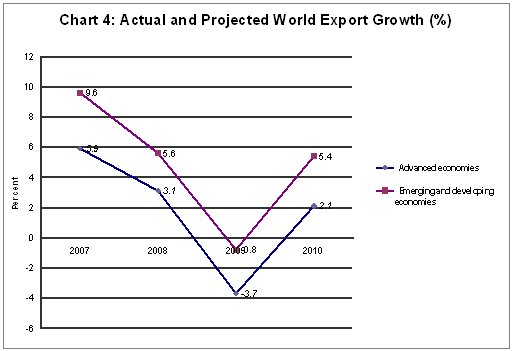

Finally, there is evidence that the global recession led by contraction

in the US is transmitting itself through global trade. Export growth

from the advanced economies is projected to fall from a positive 5.9

per cent in 2007 and 3.1 per cent in 2008 to a negative 3.7 per cent

in 2009. But this trend is not restricted to the developed countries.

The relevant figures for the emerging and developing economies are 9.6

per cent, 5.6 per cent and -0.8 per cent. (Chart 4). It is small recompense

that growth is projected to rebound sharply in 2010. Such projections

are suspect, since the IMF has made it a habit of putting out optimistic

projections and then revising them downwards.

In

fact, fear of a long recession stems not just from the distressing developed

country figures. It is also triggered by evidence that the recessionary

trend is affecting Asia as well. Developing economies in Asia, which

as a group grew at 10.6 per cent and 7.8 per cent in 2007 and 2008,

are now expected to grow at just 5.5 per cent or 1.6 percentage points

lower than projected as recently as November last year. Japan was already

contracting by 0.3 per cent in 2008, and is projected to see that figure

falling to -2.6 per cent in 2009. But the three growth engines in Asia,

the ASEAN-5, China and India also now seem to be badly affected by the

crisis. The ASEAN-5 economies, which grew at 6.3 and 5.4 per cent in

2007 and 2008, are now projected to grow at 2.7 per cent in 2009 (down

1.5 percentage points from the November 2008 estimates). The corresponding

figures for China are 13.0, 9.0 and 6.7 per cent (1.8 percentage points)

and for India are 9.3, 7.3 and 5.1 per cent (1.2 percentage points).

Moreover, the IMF has predicted a damaging immediate future for South

Korea, with its economy projected to contract by 4 per cent this year.

Estimates from national sources and elsewhere are less pessimistic than

the IMF, but there is consensus that outside the US it is Asia where

the recession is biting most. This is reflected in available estimates

on rising employment. According to official Chinese figures, more than

20 million rural migrant workers have lost their jobs and returned to

their homes as a result of the global economic crisis. According to

these estimates, by January 25, 15.3 per cent of China's 130 million

migrant workers had lost their jobs and left coastal manufacturing centres

to return home. And the aggregate figure of migrant job loss does not

include those who stayed back in cities in search of new jobs.

India too has made a feeble effort at estimating the impact of the downturn

on employment. An official survey by the Labour Bureau focuses on 8

sectors (Mining, Textile & Textile Garments, Metals & Metal

Products, Automobile, Gems & Jewellery, Construction, Transport

and the IT/BPO industry) to arrive at an estimate of job loss as a result

of the economic slowdown in the country. In these sectors it sampled

units employing 10 or more workers to make its estimates.

The

survey covered 2581 out of the sampled 3000 units of which 1168 were

from the Textile & Textile Garments industry, followed by 752 in

Metals & Metal Products, 242 in IT/BPO, 132 in Automobiles, 104

in Gems & Jewellery, 103 in Transportation, 19 in Mining, and 61

in Construction. Based on this limited sample, the total estimated employment

in all the sectors covered by the survey went down from 16.2 million

during September 2008 to 15.7 million during December 2008, implying

a job loss of about half a million (Table 1). The actual decline in

employment if coverage and method were better is likely to be much higher.

However, the survey does suggest that employment fell in every month

during this period. After September, 2008 employment in all industries

declined at an average rate of 1.01 per cent per month. A comparison

of employment in export and non-export units indicates that employment

declined at an average monthly rate of 1.13 per cent in the case of

the former, as opposed to 0.81 per cent in the latter (Table 2), pointing

to the direct role of the global slowdown.

Table

1: Trends in Average Employment, India (million) |

||||||

Period

|

Average

Employment |

%age

change |

||||

September,08

|

16.2 |

|||||

|

October,08 |

16

|

-1.21 |

||||

|

November,08 |

15.9

|

-0.74

|

||||

|

December,08 |

15.7

|

-1.12

|

||||

|

Average Monthly change |

-1.01

|

|||||

These trends in Asia are of significance because at the time when the crisis was just beginning to unfold, optimists pointed to Asia as the shock absorber that would buffer the global downturn. A decoupled Asia, it was argued, would through its own growth and the demands that it would make on the world's output ensure that the financial crisis that was largely a phenomenon restricted to the developed countries would not have as damaging an effect on global growth as the pessimists, then in a minority, were predicting.

Implicit in this confidence was the view that Asia was a region where the turn to market friendly policies was undertaken in a form and at a pace that had strengthened these economies and delivered an ''Asian century''. When sceptics pointed to the East Asian financial crisis, they were countered with the view that 1997 was an aberration that resulted from ''cronyism'' or some such intangible and not from liberalisation and global integration.

Table

2: Percentage change in Employment of Exporting and Non-Exporting units |

|||||

Period

|

Exporting

Units |

Non-

Exporting Units |

Overall

|

||

|

October,08 |

-1.3 |

-1.05 |

-1.21 |

||

|

November,08 |

-0.45 |

-1.24 |

-0.74 |

||

|

December,08 |

-1.66 |

-0.15 |

-1.12 |

||

|

Average Monthly Change |

-1.13 |

-0.81 |

-1.01 |

||

It needs

noting that the damage wrought by early liberalization had forced many

Latin American countries to search for alternative strategies. The resulting

turn in economic policy-making in Latin America has had positive consequences.

In the past a crisis in the US and other developed countries proved

damaging for Latin American countries dragging them down to degrees

far greater than the crisis in the developed countries itself. However,

this time around, growth in the developing countries of the Western

Hemisphere, which was estimated at 5.7 and 4.6 per cent in 2007 and

2008, is expected to fall to a positive 1.1 per cent in 2009. That is,

the continent seems to have escaped the kind of contraction it was prone

to in the past, when the global economy faced crises of even lesser

intensities.

It was the poor performance of much of Africa and Latin America since

the 1970s that resulted in Asia emerging as its showcase, with global

capital talking up these economies and attempting to garner the support

of domestic elites for more liberal policies. As success accompanied

each turn in policy, the shift to a regime that opened these economies

to trade, foreign direct investment and purely financial flows intensified.

Asia came to symbolise the benefits to be derived from liberalisation

and global integration, and epitomise the view that the world is flat

with no walls to climb.

Over the last two decades and more this shift towards more open strategies

has indeed transformed Asia's relationship with the rest of the world.

While the region was earlier home to a few mercantilist, export-oriented

economies like Japan, South Korea and Taiwan (Province of China), in

time every Asian economy, including the biggest, was looking for a market

abroad with some like China proving extremely successful in manufacturing

and others like India in services. Moreover, while Asia could be proud

of a high degree of regional integration through trade and investment

flows, this integration reflected not the decoupling of Asia from the

rest of the world but the creation of an export platform in which multi-country

production networks created products that were targeted at world markets.

Production processes were segmented, and each segment located at appropriate

sites that generated intermediate products that were combined at the

final location ( such as China) to be shipped abroad. The other impact

of the process of liberalisation and integration was a sharp increase

in foreign investment flows to the region, including large inflows of

portfolio capital. A concomitant of this inflow was the liberalisation

of rules regarding the presence and operation of foreign firms, including

financial firms like banks, merchant banks, insurance companies, hedge

funds and private equity firms. Capital inflows in many countries in

the region were far in excess of that needed to finance their current

account deficits. In fact, some countries with current account surpluses

were also recipients of large capital inflows.

Given such integration, it is not surprising that an Asia that was experiencing

robust growth till recently has been affected quite adversely by the

global financial and economic crisis. As the financial crisis unfolded,

foreign financial investors in need of capital to cover losses and meet

margin calls at home unwound their positions in Asia resulting in a

collapse in stock markets in many Asian economies. Countries like China,

India and Vietnam which had seen their stock markets outperforming their

global ''competitors'' were also the ones that recorded the steepest falls.

The outflow of capital put pressure on many currencies, forcing central

banks to unwind a part of their reserves. A liquidity and credit contraction

ensued. Foreign financial institutions that were located in these countries

and were facing difficulties in global markets had to downsize or close,

leading to ripple effects in domestic economies. Domestic financial

institutions exposed to sub-prime mortgage related assets recorded large

losses. Finally, the global economic recession slowed export growth

in these increasingly export-driven economies. All this generated an

Asian version of the global financial and economic crisis, which is

what the collapse in aggregate growth figures reflects.

©

MACROSCAN 2009