Themes > Features

6.05.2006

Oil and the Tenuous Global Balance

C.P. Chandrasekhar and

Jayati Ghosh

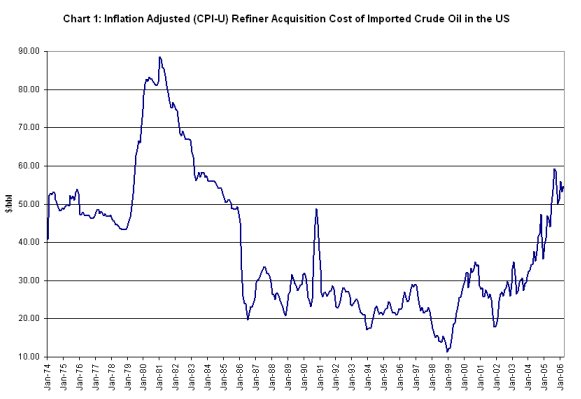

High and rising levels of oil prices have been around long enough to give cause for concern. As measured by the price of West Texas Intermediate crude, that level reached $75 to the barrel on April 21, 2006 and has remained above the $70 level since. Spot prices of Brent Crude have risen by more than 40 per over the year ending April 21. This has changed one feature of the oil price scenario during much of the last decade: that high nominal prices conceal the fact that the real price of oil is far lower than that which prevailed during the 1970s. As Chart 1 shows, measured by the Consume Price Index-deflated refiner acquisition cost of imported Saudi Light in the US, in the years since January 1974, the recent peak real price of oil was exceeded only during a brief period between July 1979 and February 1983. And signs are that if current trends persist, oil producers may regain the real price they garnered at the end of the 1979-81 shock.

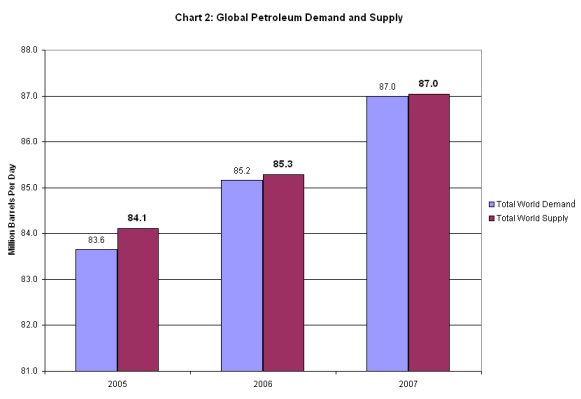

Underlying the buoyancy in prices is the closing gap between global petroleum demand and supply (Chart 2) at a time when the spare capacity held by Saudi Arabia is more or less fully utilised.

Global

demand is estimated to rise by 1.6 million barrels per day in 2006 relative

to 2005. Nearly a third of that growth is expected to come from China.

This trend, combined with the uncertainty in West Asia resulting from

the occupation of Iraq and the stand off in Iran over the nuclear issue,

had created a situation where any destabilising influence-such as political

uncertainty in Nigeria, the battle for control of Yukos in Russia, civil

strife in Venezuela or fears of the impact of periodic hurricanes in

the Gulf of Mexico-triggered a sharp rise in prices. According to reports,

the energy consulting firm Cambridge Energy Research Associates estimates

that output in Iraq is 900,000 barrels a day below pre-occupation levels;

that in Nigeria is 530,000 barrels a day below normal; production in

Venezuela is still 400,000 barrels below pre-strike performance; and

the Gulf of Mexico remains short by 330,000 barrels a day-all adding

up to a shortfall of more than two million barrels a day.

Exploiting these fundamentals, speculative forces have been keeping

oil demand and prices high more recently. It is known that price trends

in energy markets have substantially increased financial investor interest

since 2004, resulting in speculative investments in the commodity. This

has also affected the relative price of oil. According to the New York

Times (April 29, 2006): ''In the latest round of furious buying, hedge

funds and other investors have helped propel crude oil prices from around

$50 a barrel at the end of 2005 to a record of $75.17 on the New York

Mercantile Exchange.'' According to that report, oil contracts held

mostly by hedge funds rose above one billion barrels in April, twice

the amount held five years ago. To this must be added trades outside

official exchanges, such as over-the-counter trades conducted by oil

companies, commercial oil brokers or funds held by investment banks.

And price increases have also attracted new investors such as pension

funds and mutual funds seeking to diversify their holdings. While all

this means that when price expectations change the outflow of hot money

can drive oil prices sharply down, currently circumstances are in favour

of a prolonged period of high oil prices.

This naturally has raised concerns about the possible impact of the

phenomenon on global economic performance. The immediate area of focus

is on the impact it would have on the tenuous and quirky global imbalance

in which, despite a rising current account deficit on it balance of

payments, capital keeps flowing into the US to finance that deficit.

That capital flow, in turn, through its effects initially on stock values

and subsequently on interest rates and the housing market, has increased

the book value of the wealth held by Americans, encouraging them to

indulge in a debt-financed spending spree. In the event, the US economy

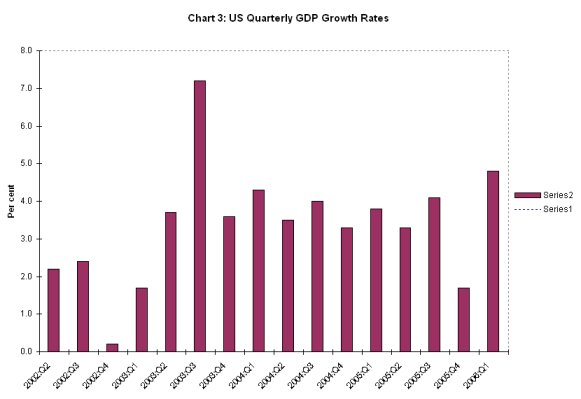

is growing at a remarkable (even if not healthy) rate. According to

advanced estimates released by the Bureau of Economic Affairs on April

28th, US GDP grew by 4.8 per cent in the first quarter of 2006. This

is not only better than the 3.8 and 4.3 per cent growth rates recorded

in the corresponding quarter of the previous two years, but amounts

to a remarkable turn around of the incipient deceleration in quarterly

growth rates from 4.1 to 1.7 per cent between the third and fourth quarters

of 2005. What is more, the quarterly GDP growth rate has been above

3.5 per cent in 9 out of the last 16 quarters (Chart 3). Not surprisingly,

Ben Bernanke, the new governor of the US Federal Reserve, recently told

the US Congress that though high energy prices were a cause for concern

in themselves, ''the prospects for maintaining economic growth at a

solid pace in the period ahead appear good.''

What

could possibly explain this resilience of US economic growth despite

the fact that the US is not insulated from the effects of rising oil

prices. One factor, often offered as an explanation is the reduced dependence

of the US on oil. As The Economist recently put it: ''In 1980 America

used a little over 17 million barrels per day (bpd) to produce GDP worth

$5.2 trillion (in 2000 dollars). By last year oil consumption reached

20.7 million bpd, but GDP had more than doubled to $11.1 trillion. As

for consumers, they are not especially dependent on petrol either. According

to the BEA, in 1970, Americans spent 3.4 per cent of their consumer

dollars on petrol and oil. By 1980 that rose to 5 per cent. Yet in 2005,

after a year of steadily appreciating oil prices, that number was 3.3

per cent.''

But this in itself is only a partial explanation, since it is not just

direct US consumption of oil which is the issue. Rising oil prices shift

the distribution of global surpluses, generating reduced current account

surpluses or current account deficits in oil importing countries and

large surpluses in the oil exporters. From the point of view of the

US, the immediate impact would be a worsening of its already widening

current account deficit. Between 2002 and 2005, the ratio of the current

account deficit of the US to its GDP rose by 1.56 percentage points

from 4.54 to 6.1 per cent. During that period the oil trade balance

worsened by 0.92 percentage points of GDP, from 0.89 to 1.81 per cent.

Thus oil did contribute significantly to the worsening of the current

account deficit.

As is well known, the US depends on flows of capital from the rest of

the world to finance its current account deficit. This process has been

facilitated by the large current account surpluses that have characterised

many countries, especially in Asia, including Japan, China, Taiwan and

India. These countries, recording current account surpluses that reflect

an excess of domestic savings over investment have invested these surpluses

in dollar-denominated assets, especially US Treasury securities. The

consequence of such flows have been two-fold: initially a boom or buoyancy

in US stock markets, and subsequently a boom in the housing market because

of the depressing effect on US interest rates that large capital inflows

have had.

If increases in oil prices reduce these surpluses and reduce the confidence

of investors from these countries in dollar-denominated assets, we should

expect a slowing of capital flows into the US and a consequent unravelling

of the tenuous global equilibrium that delivers high growth to the US.

Thus, if US growth remains robust, driven still in large part by consumer

spending, then it must be true that the above reversal of capital flows

is not being realised.

Evidence collated by the recently released World Economic Outlook (April

2006) of the IMF suggests that this is indeed the case. Three factors

according to the IMF have facilitated this. First, a sharp rise in the

surpluses of the oil exporting countries that, as expected, compensated

for any decline in surpluses elsewhere in the world. According to the

IMF, oil-exporting countries' export revenues have increased significantly

over the past two years, with OPEC revenues estimated at about $500

billion in 2005. Even during 2002-2004, well before the recent surge

in oil prices, the cumulative current account balances of net fuel exporters,

increased by close to 90 per cent from $415 billion to $782 billion.

This trend would have only strengthened since.

What is noteworthy is that unlike in the case of the 1970s the savings

which come from these increased surpluses have to be recycled to the

US rather than through the US to oil importing developing countries.

This is because, those countries for varied reasons, but especially

a deflationary fiscal stance have been characterised by current account

surpluses, whereas the US is characterised by current account deficits.

This makes the recycling process, which could occur through two channels,

much simpler. One would be increased global demand from the fuel exporters,

which favours countries outside the US that are more competitive. This

would further increase their current account surpluses which would then

be invested in larger measure in the US, to finance the latter's deficit.

The other would be, for savings to increase disproportionately in the

fuel exporters, and the direct investment of these financial savings

in US paper and banks deposits. On the surface it appears that deposits

with the banks have been important, but this is partly because flows

into US paper including Treasury Bills can occur through third country

agents, such as those in London. Whatever be the route, the impact would

be to continue to finance US deficits, to sustain thereby the US dollar

and to keep interest rates depressed in the US, allowing for the continuation

of the debt financed boom for the time being.

The losers would be the developing countries without surpluses on their

current account. They would experience a worsening of their deficits

that would have to be financed by high cost capital flows from the US

and elsewhere. In the event they would have to reduce their demand for

dollars, if they have to manage their balance of payments, by curtailing

growth. In sum, once again the structure of the global economy, in which

the US remains the global financial hub, seems to be working in a way

that places the burden of the redistribution of global income in favour

of one section of the developing world (the oil exporters) on other

developing countries (the poorer oil importers), rather the developed

countries.

© MACROSCAN 2006