For more than a year now, it has been evident that

the ''recovery'' from the Great Recession, which has

been visible if sputtering in terms of output growth

in the core capitalist countries, has not delivered

anything like the increases in employment that were

expected. A recent report of the ILO (''Short-term

employment and labour market outlook and key challenges

in G20 countries'', ILO and OECD September 2011, page

1) points out: ''With economic activity slowing in

several major economies and regions, earlier improvements

in the labour market are now fading, hiring intentions

are softening and there are greater risks that high

unemployment and under-employment could become entrenched.

This makes for a highly uncertain outlook as to the

timing and strength of a future recovery in employment.

Continued weak growth in employment in many G20 countries,

in turn, will make it impossible in the near term

to close the jobs gap accumulated during the crisis,

which amounts to more than 20 million jobs.''

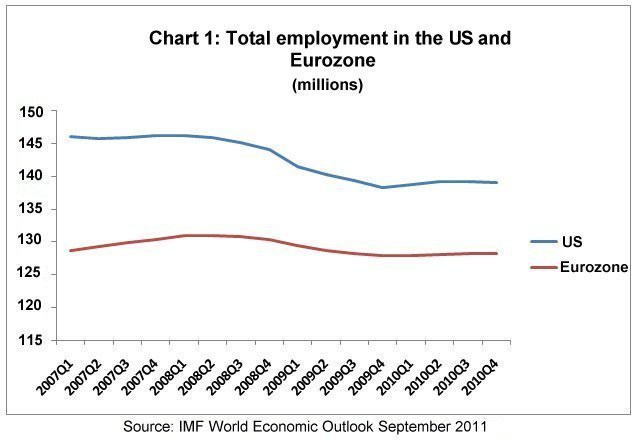

Even the IMF, notorious for giving relatively short

shrift to employment and seeing it as generally strongly

correlated with output, has woken up to the severity

of the problem in its latest World Economic Outlook

September 2011. As Chart 1 indicates, the collapse

of aggregate employment in the US and the continued

stagnation at low levels in the eurozone do not point

to any real recovery at all in terms of employment.

Now that the global economic horizon has been darkened

once again by very real fears of the next dip, the

concern is that employment conditions will deteriorate

further.

Chart

1 >> Click

to Enlarge

It

is true that the IMF’s analysis of the problem and

possible solutions remains weak, also because it continues

to stress the need to encourage ''a rebalancing from

public to private demand'' in these core capitalist

regions, at a time when this is completely unrealistic

to expect. A major cause of the crisis was the excessive

build-up of private debt (taken by both households

and companies) that could not be sustained. These

private agents now necessarily have to go through

a period of deleveraging. In that period, if aggregate

demand has to grow at all, it must come from the public

sector – but the combination of bond market vigilantes

and fiscal hawks active politically has forced governments

in both these areas to move to premature fiscal retrenchment.

In this analysis, the fact that there was not more

of an employment recovery is a source of surprise.

After all, the G20 countries did at first combine

to provide very large fiscal stimuli in the major

countries, and in the developed world monetary easing

has continued, leaving the world economy awash with

liquidity. The argument seems to be ''we adopted Keynesian

policies, but they have not delivered employment growth''.

This is actually less than the truth. Part of the

problem is that the stimulus measures adopted in most

countries were not weighted in favour of employment

generation: a disproportionate amount went as bailouts

and support to large financial institutions that simply

used the resources to clean up their balance sheets.

In the US, very little of the money went into direct

state spending on activities that directly increase

employment or have high multiplier effects. Social

spending and government employment fell as local governments

were strapped for cash; small businesses have been

starved of bank credit; there has been no systematic

attempt to address the continuing problem of foreclosures

in residential housing markets. And now, even these

half-hearted and slipshod stimulus measures are to

be clawed back with the new focus on fiscal austerity.

In Europe the imbalances in the eurozone are also

being dealt with in a counterproductive manner – forcing

regressive austerity measures on to deficit countries

and sending them into a downward spiral of falling

output and employment in which their fiscal and public

debt measures will only get worse. It is ridiculous

to expect private investment and activity to increase

to fill the slack created by public cuts, in this

context of continuing crisis. So it is not surprise

that employment is not recovering.

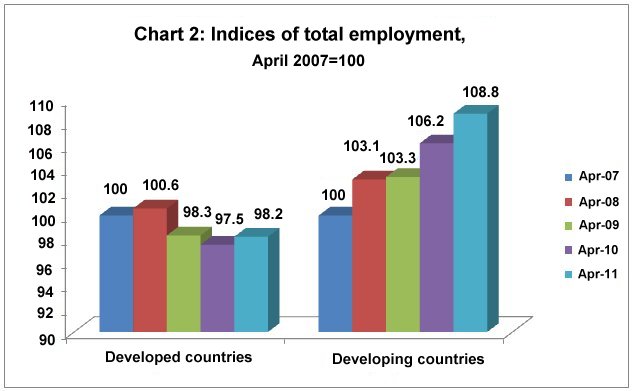

The poor performance of employment in the developed

countries has reinforced perceptions that the crisis

has intensified and accelerated structural shifts

in global employment away from the rich countries

to certain emerging markets. Certainly, the data presented

in Chart 2 would appear to support that view. It is

evident that total employment in developed countries

has still not recovered to pre-crisis levels. However,

in developing countries total employment did not fall

after the crisis, and since then has continued to

rise.

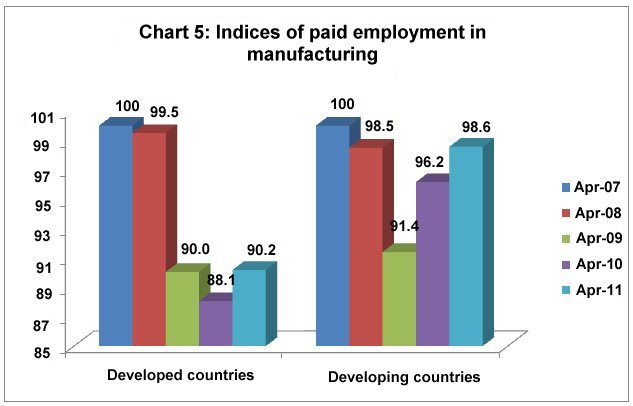

The data in Charts 2 to 5 (all from the ILO’s Short

Term Indicators of the Labour Market, September 2011)

should be interpreted with some caution, since they

relate only to (around 54) countries that provide

recent employment data of the required periodicity,

and large countries such as China and India are therefore

excluded. Even so, they provide a quick estimate of

the ongoing trends.

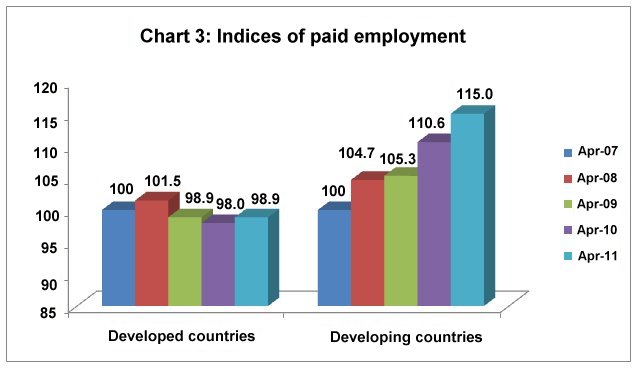

Chart 3 indicates a similar picture for paid employment

(or number of employees): - the slight decline followed

by stagnation at below pre-crisis levels in the developed

world accompanied by continuing increase in such numbers

in the developing world. The level of paid employment

in April 2011 was around one per cent below pre-crisis

levels in the developed countries for which estimates

are available, but 15 per cent higher for developing

countries.

Chart

2 >>

Click

to Enlarge

Chart

3 >>

Click

to Enlarge

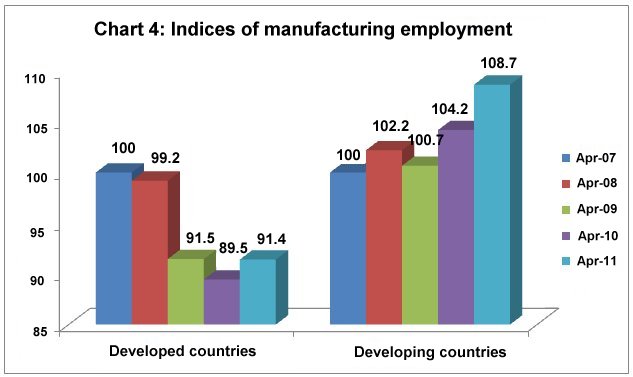

The biggest shift, and the one that has grabbed the

most attention and created disquiet in rich countries,

is the shift of manufacturing employment. This was

a shift that was widely discussed but did not actually

take place in the preceding decades: in fact aggregate

manufacturing employment in the developing world did

not increase despite the widespread perception of

the North ''exporting jobs'' to the South. But the very

recent trends after the global crisis suggest that

the shift may be occurring now.

Chart

4 >>

Click

to Enlarge

Chart 4 shows that manufacturing employment in developed

countries was more than ten per cent below the pre-crisis

level in April 2010, and has since recovered only

slightly to be still around 9 per cent lower in April

2011. Meanwhile, after a minor blip in early 2009,

manufacturing employment in developing countries continued

to increase, such that in April 2011 it was nearly

9 per cent higher than its level of four years earlier.

Surely this is a clear sign that the much feared (or

much anticipated) shift of manufacturing activity

to the South is finally taking place and that the

location of additional manufacturing employment will

now be concentrated in the South? It turns out that

even this is not so clear, if such employment is further

disaggregated.

Chart 5 shows the indices of paid employment in manufacturing

(that is, the total number of employees rather than

self-employed engaged in manufacturing activity).

This presents quite a different picture: one in which

the level have fallen after the crisis, in both developed

and developing countries! Indeed, in April 2009 the

collapse in paid manufacturing employment was similar

in both regions, at around 8-10 per cent lower than

the April 2007 level. The recovery in developed countries

thereafter was negligible. Such employment recovered

more rapidly and sharply in developing countries,

but in April 2011 the level was still below the pre-crisis

level of paid manufacturing employment even in developing

countries.

Chart

5 >>

Click

to Enlarge

So the only real increase in manufacturing in developing

countries seems to have been in self-employment. What

exactly does this mean? This really points to the proliferation

of petty activities at the bottom of the production

chain, typically in low productivity and low paid work

that usually reflects the absence of other viable income

earning opportunities. The expansion of self-employment

in manufacturing in the developing world, including

in some of the most ''dynamic'' emerging markets, cannot

be seen as a very positive sign of industrial relocation,

especially in a world in which economies of scale are

still rampant. It essentially indicates a growing tendency

to newer forms of organisation of production in which

there is international centralisation of production

but decentralisation of the actual work processes, with

the risks of production borne largely by the self-employed

workers themselves, at the bottom of the production

chain.

Recently released survey data from India (the National

Sample Survey for 2009-10) suggest that even such employment,

low paid and adverse as it is, can also be fragile and

transient and therefore decline. If this is a more widespread

tendency, when more data are eventually available for

all developing countries, we may find that aggregate

manufacturing employment in developing countries has

barely recovered after the crisis.

*

The article was originally published in the Business

Line, October 3, 2011