There

was a time when global oil prices reflected changes

in real demand and supply of crude petroleum. Of course,

as with many other primary commodities, the changes

in the market could be volatile, and so prices also

fluctuated, sometimes sharply. More than any other

commodity, the global oil market was seen to reflect

not only current economic conditions and perceptions

of future activity, but also geopolitical changes

and cross-currents.

Ever since the early 1970s, when group of some major

oil exporting countries OPEC, forced a three-fold

increase in global oil prices its shadow has loomed

large. There is still widespread perception that the

cartel of oil-exporting countries can manipulate and

influence the price by changing the level of their

own supplies. As a result, even oil-exporting countries

that are not members of the cartel have benefited

from OPEC's decisions about supply, since they have

also been beneficiaries of rising oil prices.

But in fact, OPEC is more like a club of a minority

of oil producers, rather than a cartel that is in

command of world oil supply. It controls less than

40 per cent of world oil production, compared to 70

per cent in the early 1970s. Non-OPEC countries account

for increasingly significant proportions of global

supply: Russia has overtaken Saudi Arabia as the largest

supplier of crude oil since 2009. Partly as a result

of this, OPEC has recently been quite inefficient

in imposing any kind of production quota on its members,

who have happily increased or decreased their production

as they wished. Most of its members are producing

exactly as they would if OPEC did not exist.

Indeed, for the past two decades, OPEC's role has

generally been more towards price stabilisation rather

than pushing for increases, and it may even have played

a moderating role in oil markets, including when particular

events such as political disruptions in major exporting

countries caused sudden supply shortfalls. OPEC formerly

abandoned its declared price band in 2005, and since

then has been largely powerless in determining prices.

The argument that rising demand from China and India

has determined the upward trend in global oil prices

is also unjustified. While these two countries (and

particularly China) do account for growing (but still

small) shares of global demand, these increases have

been counterbalanced from slower demand from other

regions of the world, including the US and Europe.

As a consequence, on average, global oil demand has

continued to grow at between 1 and 2 per cent per

annum over the past five years, usually at a rate

slightly below the annual rate of increase in global

oil production.

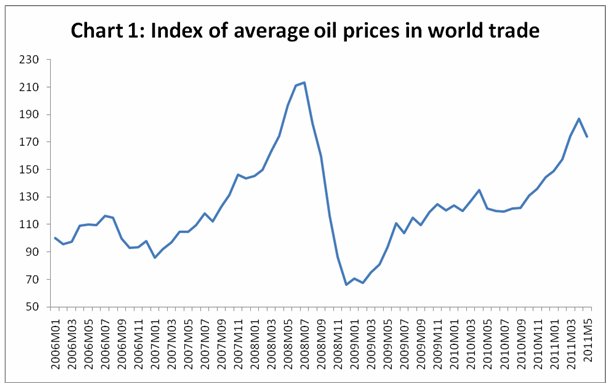

Recent price changes in global oil markets are increasingly

affected by other forces, which have more to do with

financial speculation and expectations than with current

movements in demand and supply. Chart 1 indicates

the extent of the recent rise, and shows how much

it mirrors the earlier rise in oil prices between

January 2007 and June 2008.

Chart

1 >> Click

to Enlarge

This confirms the points made earlier about the role

of other factors in global oil markets. Clearly, this

extent of price volatility – with dramatic rise, fall

and rise again within the space of three years - cannot

be the result of real demand and supply changes. Despite

this, most mainstream media persist in trying to isolate

some factors affecting production in particular locations,

to account for the price changes.

The ongoing crisis in the Middle East – and particularly

Libya – is generally believed to be the impetus behind

the latest spurt in prices. But Libya produces less

than 3 per cent of global petroleum output, and Saudi

Arabia (whose current excess stocks are already more

than annual production in Libya and Algeria) has already

made up current shortfalls and promised to compensate

for any future shortfall. Since the unrest in the

Arab region began, there has been no significant change

in global oil production, which continues to average

around 88 million barrels per day.

In any case, currently global spare oil capacity is

closer to historic highs than to historic lows. Proven

reserves of oil amount to more than 40 years worth

of global consumption at current levels – the highest

such ratio in the past thirty years.

The current price spike is therefore not the result

of demand and supply imbalances but is driven by uncertainty,

rumour and speculative financial activity in oil futures

markets. Even in terms of expectations, Libya is only

part of the problem (and in fact oil production still

continues in many Libyan facilities despite the civil

war). The concern in financial markets may be more

about the potential endgame if the unrest spreads

to Saudi Arabia. But the increase in oil prices is

happening well before such a drama actually plays

out, and before any serious disruption to global supply.

It is therefore likely that the rapid increases in

oil price and the associated price volatility over

the past year in particular, are largely driven by

purely financial activity. This is very similar to

the effects of financial speculation on other commodity

markets such as food items. The volume of trading

in crude oil futures contracts has expanded dramatically

over the past decade. As noted by Robert Pollin and

James Heintz (''How speculation is affecting gasoline

prices today'', Americans for Financial Reform mimeo,

July 2011), the overall level of futures market trading

of crude oil contracts on the New York Mercantile

Exchange is currently 400 percent greater than it

was in 2001, and 60 percent higher than it was two

years ago. Even relative to the increases in the physical

production of global oil supplies, trading is still

300 percent greater today than it was in 2001, and

33 percent greater than two years previously.

The ratio of ''open interest'' contracts of NYMEX

(New York Metals Exchange) crude oil futures to total

global oil production is one useful indicator of the

growing extent of speculative activity in this market.

This ratio was between 4-6 per cent in the first half

of the 2000s, increased to 12 per cent in late 2006

and then to as much as 18 per cent just before the

oil price peaked in June 2008. It then fell to 13

per cent in the middle of 2008, as oil prices fell.

It has been mostly rising since then, with average

levels of 16 per cent in the past few months. Large

traders in particular show growing volumes of ''long''

positions that anticipate future price increases.

(Data from Commodity Futures Trading Commission website

www.cftc.gov

accessed 6 July 2011).

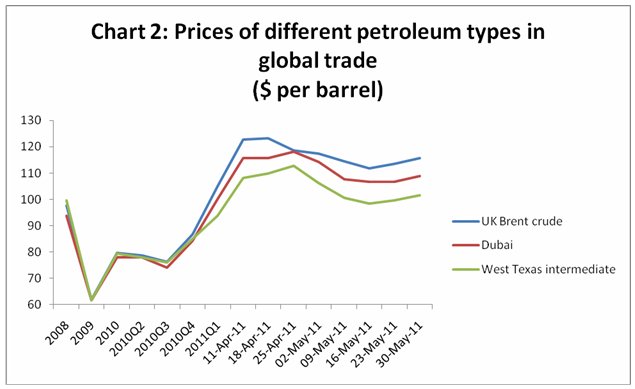

While this explains some of the recent volatility

witnessed in oil prices, there are some other more

puzzling features of the recent price increases. Earlier,

the three major forms of crude petroleum in the global

market – Brent Crude, West Texas Intermediate and

Dubai crude – generally showed similar if not identical

prices. If anything, the price of West Texas Intermediate

oil used to be slightly higher because of perceived

better quality and lower sulphur content.

However, in the very recent past the prices have diverged,

and as Chart 2 shows, West Texas Intermediate is now

the lowest of the three prices. By the middle of June

the difference was more than $22 per barrel. It is

not fully clear what is causing this deviation, especially

the increasing extent of it. But it is also true that

futures market activity is greater

for both Brent and Dubai

crude oil.

Chart

2 >> Click

to Enlarge

We all know who loses from rising oil prices: most

of us. Oil prices directly and indirectly enter into

all other prices, through higher fuel costs of production

and transport. Agriculture is directly affected, so

food prices will definitely rise further with this

oil price increase, worsening the resurgent food crisis.

Such cost pressures have another consequence: they

push governments to inflation control measures, such

as higher interest rates. In many countries this worsens

the chances for the already fragile economic recovery

after the crisis. So people across the world face

lower real incomes and may face reduced employment

opportunities.

Oil-importing developing countries tend to get hit

much worse than other oil importers. First, the energy-intensity

of output is still much higher (twice on average)

than production in OECD countries. Second, developing

countries are often more foreign exchange-constrained

and so high oil import bills lead to balance of payments

difficulties. The poorest countries are usually the

worst affected, and within developing countries poorer

groups take the brunt of the impact in higher costs

of living and lower wage prospects.

So the doubling of the oil price that we have seen

in the past year has already destroyed any positive

effects of foreign aid that oil-importing developing

countries receive. Since it is also linked to global

food prices the negative effects are compounded for

food importing countries. During the last such price

peak in 2008, there were calls for compensatory financing

to be provided to oil and food importers by the IMF.

This never came about, but this time round we have

not even heard such noises, certainly not loudly enough.

Who gains from the rising oil prices? The conventional

approach is to look at the countries that are major

oil exporters, and somehow assume that they are the

beneficiaries of such price spikes, and that this

leads to a redistribution of global income away from

oil-importing to oil-exporting countries. This approach

is reinforced by the media, which keeps emphasising

the windfall gains of governments in oil exporting

countries.

But this misses the point. The really big gainers

– accounting for the largest portion of the gains

by far – are the big oil companies. In fact, big oil,

which suffered a setback during the Great Recession,

is back with a bang, riding on the back of the recovery

in petroleum prices in 2010. The major oil companies

that announced their results in January 2011 reported

a doubling of profits in 2010 compared to the previous

year. The three big US companies ExxonMobil, Chevron

and ConocoPhillips together had nearly $60 billion

profits after all costs and taxes. The profits of

the Anglo-Dutch company Royal Dutch Shell also doubled,

even though production was lower than expected.

Why do profits of big oil companies increase so much

during periods of high or rising oil prices? Basically,

the costs per barrel of the companies reflect their

historical costs of drilling, exploration and/or purchase

of crude oil, which often have little or nothing to

do with current crude prices. But they are quick to

pass on current crude oil prices to consumers in the

form of higher prices for their products. By contrast,

they tend to be much more lethargic about passing

on lower crude prices in the form of lower prices

of processed oil. So increases in crude oil prices

lead to enormous windfall gains for these companies.

In the current price surge, therefore, the real (and

maybe only) gainers are financial speculators in oil

futures markets and the big oil companies that can

pass on much more than their own costs in the form

of much higher prices due to the general sense of

frenzy in oil markets. So the case for immediate and

substantial taxes on the windfall oil profits of multinational

companies is very compelling. And so is the case for

much more far-reaching and effective regulation and

control of the speculative activity in oil futures

and other commodity markets that is currently causing

so much collateral damage.

*This article was originally

published in the Frontline, Vol.: 28, No. 15, July

16-29, 2011.