Chart

1 >> Click

to Enlarge

President Barack Obama has unveiled features of a

new tax reform plan as part of his campaign for a

second presidency, which, if implemented, could impact

the developing world. Given the rising debt of the

government, the resulting pressure to raise revenues

or cut government expenditures and the evidence that

the effective taxation of America's rich falls short

of average, the tax regime was an issue that any Democratic

candidate had to address. The case for raising tax

revenues is strong.

But the opposition to any such increase from many

among those who finance Obama's campaign is also strong.

They harp on the fact that America has the highest

marginal corporate tax rate in the world after Japan.

And Japan is reducing its rate from April this year.

So President Obama had to walk the tightrope. That

he appears to have done well by making three distinctions.

Between rich individuals and corporations, between

a simple and cumbersome tax system and between corporations

that serve America while serving themselves and those

that only look to their own profits.

By making the first of these distinctions, the President

proposes to tax rich individuals more while reducing

taxes on corporates that create productive assets

and provide jobs. He is threatening to impose the

''Buffett rule'' that those earning more than a million

dollars a year should pay a minimum of 30 per cent

of that income as tax. But to balance this, he has

proposed a substantial cut in the US corporate tax

rate from 35 to 28 per cent, with even lower rates

for manufacturing and ''advanced manufacturing''. Clearly,

the idea here is to highlight a push for investment,

growth and jobs.

The second distinction, between a complex and simple

tax system, is made to argue that the reduction in

the corporate tax rate needs to be accompanied by

a simplification of the tax system, which eliminates

multiple concessions that introduce distortions. The

most obvious of those distortions is that while the

US has among the highest marginal corporate tax rates

in the world, the corporate tax to GDP ratio in the

US is among the lowest among OECD countries. The US-based

Center for Tax Justice has found that the US has the

second lowest corporate tax to GDP ratio in the developed

world, falling only behind Iceland. A study by research

firm Capital IQ for the New York Times found that

of the 500 companies included in the Standard and

Poor's stock index, 115 were subject to an effective

total (federal and other) corporate rate of less than

20 per cent during the five years ending 2010. Yet,

over time corporate tax revenues in the US have fallen

from 4 per cent of GDP in 1965 to just 1.3 per cent

in 2009. To justify a corporate tax rate reduction

in this context, President Obama has proposed a rationalisation

of the tax system that puts an end to tax breaks given,

for example, to the oil and gas industry and the private

equity business, and benefits such as accelerated

depreciation, which permits companies to write off

assets against tax at a faster rate than they actually

depreciate in economic terms.

Finally, the third distinction, between profits brought

back home and those retained abroad, is made to argue

that the President intends to end the discrimination

against firms that provide Americans jobs by investing

profits at home as opposed to retaining them abroad.

It is here that the President was strident: ''Our current

corporate tax system is outdated, unfair, and inefficient.

It provides tax breaks for moving jobs and profits

overseas and hits companies that choose to stay in

America with one of the highest tax rates in the world…It's

not right and it needs to change.'' US firms earning

profits abroad and choosing to retain them there are

not taxed in the US on those profits. But if they

choose to bring them home then they are subject to

the US corporate tax regime. This does encourage US

corporations to retain and invest their profits abroad,

especially in countries where the effective tax rate

is significantly lower than in the US. Obama now wants

to give up this ''territorial'' system of taxing profits

of US multinationals and impose a minimum tax that

needs to be paid on overseas profits, whether repatriated

or not.

It is not clear how effective such a system of reducing

the differential tax on repatriated and retained profits

would be. But there is evidence that when tax concessions

are offered on profits repatriated back to the US,

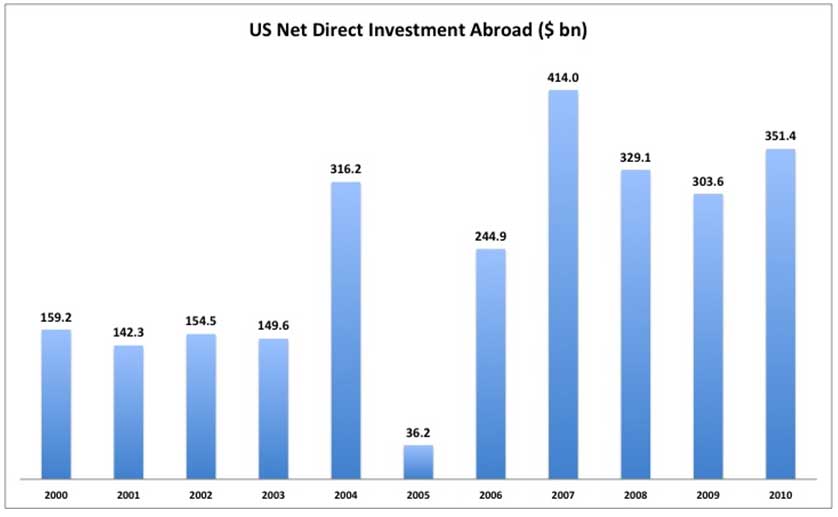

corporations do respond. As the accompanying Chart

shows, US net direct investment abroad, which ruled

high in the latter part of the last decade, registered

a dramatic decline in 2005. The drop in 2005 reflected

the decision by U.S. parent firms to reduce the amount

of reinvested earnings going to their foreign affiliates,

in order to repatriate profits home and take advantage

of one-time tax provisions in the American Jobs Creation

Act of 2004 (P.L. 108-357). That act allowed U.S.

companies that received dividends from foreign subsidiaries

during a specific period (calendar year 2004 or calendar

year 2005) to be taxed at reduced rates, on the condition

that they worked out a domestic reinvestment plan

for the dividends granted that benefit. Many companies

chose to use that opportunity in 2005, when much of

such dividends were paid out, because the act was

signed into law only late in 2004.

If a similar, more long-term, consequence were to

follow the implementation of the proposed reduction

in the tax rates on reinvested as opposed to repatriated

overseas profits of US MNCs, US business may at the

margin choose to return home. In this they would also

be encouraged by the fact that in at least one of

the countries that is their favoured destination,

viz. China, there are signs of labour shortages and

a rise in wages, besides currency appreciation, which

erode its competitiveness as a location. According

to The New York Times, a report recently released

by the Chinese government argues that this year's

post-Spring Festival labour shortage was more pronounced

than in earlier years and also longer and wider in

scope. There are other reports that the migrant worker

pool on the basis of which industry in China's export-oriented

zones grew is shrinking. An important reason is that

the government's effort to improve rural well-being

and reduce the rural-urban imbalance is delivering

results and encouraging workers to stay back in their

rural homes.

This in itself may not ensure the return home of American

business. Many produce in China because it is the

Chinese market that they are targeting. Others may

choose to shift, but to other low-wage locations rather

than back to the US. But the evidence suggests that

Obama's ploy to justify tax concessions to corporations

in a country where they are effectively undertaxed

may end up working.

*This article was originally

published in 'The Hindu' and is available at

http://www.thehindu.com/opinion/columns/

Chandrasekhar/article2953629.ece