Initially, the still-evolving crisis in Europe was

read as being the result of excess public debt and

poor public finances. Though this debt was owed to

the banks, especially European banks, the latter were

seen as protected. Default on debt owed to them would

damage the financial system, worsen the real economy

crisis, break the Eurozone and end the euro. Governments

that had come together to constitute the Eurozone

and adopt a common euro would hardly opt for this

scenario stemming from a default by them that could

damage bank profitability. Using that argument, the

financial community worked overtime to call for action

that would save the banks at the expense of the countries

of the Eurozone and their populations.

It is now clear, however, that this strategy would

not work. Governments seeking to ''adjust'' through

austerity are finding their public finances worsening

rather than improving, eroding further their ability

to avoid a default on debt commitments. Thus, banks

are being required to take a haircut, currently set

at 50 per cent of loan value, up from 20 per cent

a few months earlier. This could get even higher.

Given the damage that this would do to bank profits

and balance sheets, a recapitalisation of European

banks is imperative, with the current overly conservative

estimate placing the funds required for that purpose

at €106 billion. In addition, with European regulators

set to agree on a revised core (tier one) capital

ratio of 9 per cent for their banks, this figure could

go up to €275 billion, according to Morgan Stanley.

As of now, banks are required to dig into their global

reserves (if any), approach the private markets for

debt and equity, as well as take support from governments,

through the European Financial Stability Facility

(EFSF). But with most European governments unwilling

or unable to provide funds, the EFSF's future strength

is still uncertain. Thus, a significant retrenchment

of still performing assets by European banks and a

persisting and possibly worsening real economy crises

seems unavoidable as of now.

This has led to much discussion on how a European

banking crisis would affect the rest of the world.

Our concern here is with the impact on developing

countries, especially the developing countries or

the ''emerging markets'' in Asia exposed significantly

to global banks.

It is now well accepted that one of the consequence

of financial globalization has been the increased

presence of global banks in developing countries and

an increase in their role as lenders in these countries.

This process has, of course unfolded to different

degrees in different regions of the world. Between

1995 and 2005, the share of foreign banks in total

bank assets rose from 25 to 58 per cent in Eastern

Europe and from 18 to 38 per cent in Latin America,

though even by that date the increase in East Asia

and Oceania was much less (from 5 to 6 per cent).

With this increase in presence, the share of foreign

banks in lending to non-bank residents has been rising.

Since the mid-1990s (and by 2009) the share of foreign

banks in credit to non-bank residents rose from 30

to 50 per cent in Latin America, to nearly 90 per

cent in emerging Europe, but is still at about 20

per cent in emerging Asia.

Chart

1 >>

Click to Enlarge

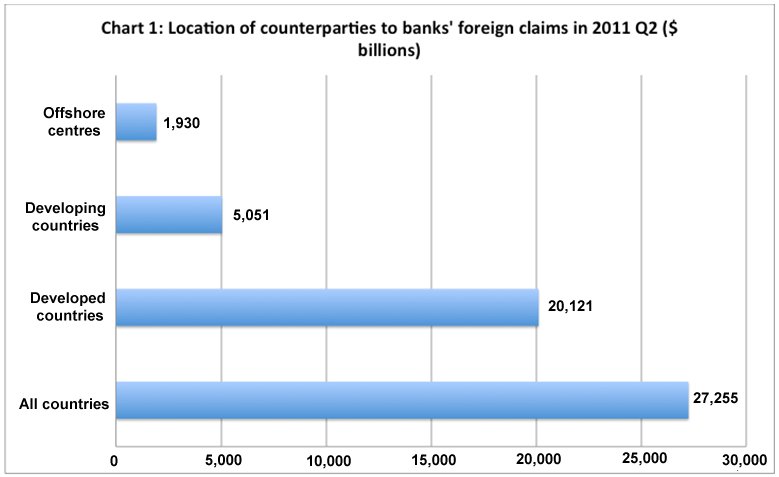

As of the end of the second quarter of 2011, banks

in countries reporting to the Bank of International

Settlements (BIS) had foreign claims of $27.3 trillion

outstanding. Though a dominant share ($20.1 trillion)

of these accumulated claims was in the developed countries,

the developing country share ($5.1 trillion) was by

no means meagre (Chart 1). What is particularly noteworthy

is that the international banks involved are predominantly

European. Around 70 per cent of the foreign claims

of the global banking system is on account of European

banks. Greater financial integration in Europe is

one obvious reason. Of the $20.1 trillion claims on

the developed countries, $12.3 trillion is in European

developed countries, as compared with just $5.6 trillion

in the US.

But another part of the reason is that European banks

faced with increased competition at home are now seeking

out developing countries to expand business and sustain

profitability. Close to 20 per cent of the exposure

of banks abroad is in developing countries, and this

is true of European banks as well (Table 1). Given

the greater role of European banks in total international

funding and the importance of a few developing ''emerging

markets'' as recipients of capital, this is of significance.

The concentration of emerging market exposure in banks

from one region increases the vulnerability of both

these banks and their clients. But as discussed below,

given the asymmetric nature of the relationship between

foreign banks and their emerging market clients, this

vulnerability is the greater for the latter, especially

in the context of the current crisis in Europe.

Table

1: Foreign exposure of banks by region (Per

cent) |

|

00

|

All

banks |

European

banks |

| Developed |

73.8 |

74.7

|

| European Developed |

45.3 |

49.3

|

| US |

20.7 |

20.0

|

| Offshore Centres |

7.1 |

5.8

|

| Developing |

18.5 |

18.9

|

| Dev'ing Af

& ME |

2.2 |

2.6

|

| Dev'ing Asia

& Pacific |

6.5 |

4.9

|

| Dev'ing Europe |

5.2 |

6.9

|

| Dev'ing

LA&C |

4.6 |

4.5

|

Table

1 >>

Click to Enlarge

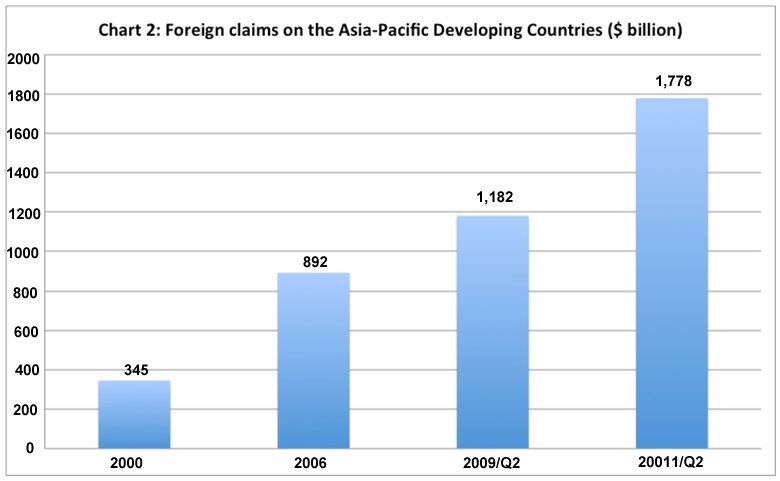

In the current context, the vulnerability of the developing

countries, as demonstrated by the experience during

the 2008-09 crisis, comes especially from one source.

Having to cover losses at home, recapitalise themselves

and improve the risk profile of their lending, European

banks are likely to look to transferring profits and

retrenching assets in their global operations. Emerging

markets are bound to be affected by such moves. Among

emerging markets, those in the Asia-Pacific, normally

presented as relatively ''decoupled'' from the developed

West, are just as vulnerable. As much as $1.8 trillion

of the $5.1 trillion of global banking foreign claims

located in developing countries are in the Asia-Pacific.

Chart

2 >>

Click to Enlarge

The disconcerting feature of these claims is that

they seem to have been driven to a substantial degree

by short-term supply side developments in the developed

countries. As Chart 2 shows, foreign claims on the

Asia-Pacific developing countries rose by $547 billion

during the period 2000-2006, when there occurred a

supply side driven surge in capital flows across the

globe. Even during the crisis period stretching from

2007 to the middle of 2009 foreign bank claims in

the region increased by $290 billion. And when the

post-crisis liquidity infusion made available cheap

capital in large quantities to the banking system,

the Asia-Pacific developing countries were the locations

for an expansion of foreign bank claims to the tune

of $596 billion in just two years. A capital surge

of this kind, that provided additional grounds for

the ''decoupling'' perspective, makes the region even

more vulnerable to a capital outflow or a mere cutback

in lending by foreign entities.

Chart

3 >>

Click to Enlarge

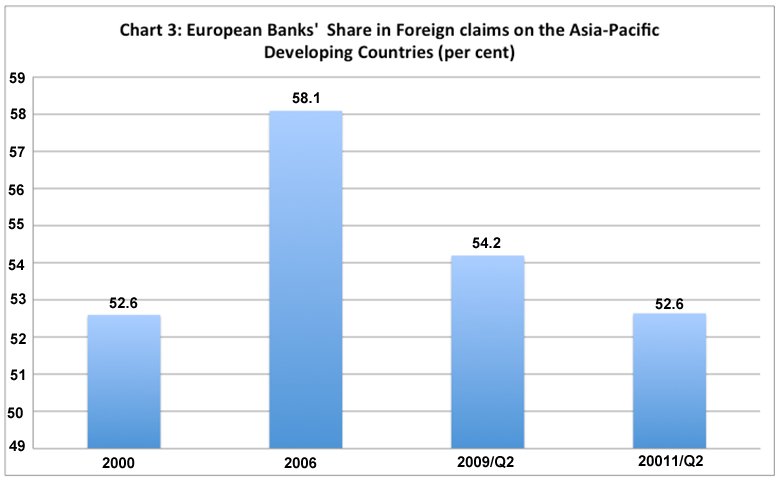

Given what we noted earlier, this vulnerability is

greater because of the importance of European banks

in the region. The share of European banks in these

claims in the developing Asia-Pacific rose from 53

to 58 per cent between 2000 and 2006, and has since

fallen to 52.6 per cent (Chart 3). Part of the reason

for that decline is the fact that the liquidity infusion

into the banking system has been far more in the US

than in Europe in the aftermath of the crisis. But

it is also a reflection of the fact that European

banks have been turning more cautious and possibly

retrenching assets when they mature, to transfer funds

to their parent entities.

Table

2: Accumulated Foreign Bank Claims as a

Percentage of GDP in Emerging Asia |

| 00 |

China |

Indonesia |

India

|

Korea |

Malaysia |

Thailand |

2005 |

3.3 |

9.0 |

9.7 |

24.2 |

52.7 |

18.6 |

2006 |

4.7 |

9.3 |

12.3 |

27.1 |

54.1 |

20.1 |

2007 |

6.1 |

10.8 |

16.0 |

31.6 |

55.9 |

18.2 |

2008 |

3.9 |

9.4 |

15.1 |

29.3 |

44.5 |

17.1 |

2009 |

4.6 |

10.0 |

14.9 |

37.5 |

53.6 |

21.7 |

2010 |

6.1 |

10.5 |

15.3 |

31.4 |

52.6 |

22.9 |

Table

2 >>

Click to Enlarge

That being said, how important are these foreign bank

claims to the Asia-Pacific developing countries? It

is indeed true that in many of them the annual flows

of capital that those claims represent are small when

compared to the aggregate annual flow of debt, equity

and other claims. However, as accumulated claims these

do constitute a significant amount relative to GDP

in most Asian emerging markets, excluding China (Table

3). At 15-20 per cent in India and Thailand and as

much as 30-50 per cent in Korea and Malaysia, these

accumulated claims are a source for concern. Any sudden

retrenchment can create liquidity as well as foreign

exchange difficulties.

This vulnerability needs to be assessed in the context

of the collateral damage that a banking crisis in

Europe can result in. It would worsen the recession

in Europe, which is an important destination for exports

from Asia. The recession in Europe would in turn precipitate

the double dip that can damage Asia's foreign exchange

earnings and growth even more. And finally, the European

banking crisis could trigger a global crisis, not

just in banking but in the financial sector generally,

given the multiple institutions and instruments through

which financial markets are interlinked today. If

that occurs, what matters is the aggregate exposure

of the Asia-Pacific to global capital: and that is

indeed substantial. Asia too needs to look to protecting

itself in the near future.