There

is a palpable sense of gloom and impending doom in

most discussions of the world economy today. Even

before, several economists had argued that the excessive

optimism about ''V shaped recovery'' that was being

used to describe the economic revival in 2010 was

premature and misplaced, especially as none of the

fundamental contradictions of global capitalism that

led to the previous crisis had been adequately addressed.

But they were once again written off as Cassandras

by the financial media, which desperately sought sources

of ''good news'' and future engines of growth particularly

among the emerging markets.

Now even the most stalwart establishment voices are

expressing growing concern and pessimism. Oliver Blanchard,

Chief Economist at the IMF, has issued what must be

an unprecedentedly sombre and even dismal statement

at the close of the year, noting that recovery is

at a standstill in the advanced economies and recognising

that 2012 may face even worse economic conditions

than 2008.

Blanchard refer euphemistically to ''multiple equilibria

- self-fulfilling outcomes of pessimism or optimism,

with major macroeconomic implications'' and effectively

suggests that unless private expectations are managed

better by decisive government policies, negative expectations

will become self-fulfilling. But it is harder for

governments to ''manage expectations'', because private

investors themselves are schizophrenic about government

deficits and economic growth. Financial markets effectively

appear to demand fiscal consolidation by putting very

high spreads on the bonds of governments with high

ratios of public debt to GDP or fiscal deficit to

GDP. And then investors in these markets are very

surprised (and react adversely) when attempts at fiscal

austerity reduce economic activity and growth prospects.

This has already created a self-reinforcing cycle

of contraction in the eurozone, and as long as European

leaders (and incidentally the IMF) continue to press

for fiscal austerity, this will continue. Meanwhile

the peculiar political configurations in the US make

it unlikely that any real fiscal stimulus will emerge

to ensure a more broad-based and stable economic recovery.

The belief currently expressed by many economic commentators,

that a ''big bazooka'' in the form of even looser

monetary policy of the European Central Bank and the

US Federal Reserve, will be sufficient to lift economic

activity, is unwarranted.

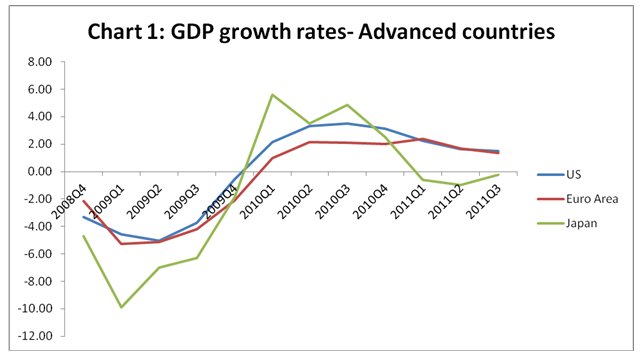

Chart 1 shows quarterly growth data for real GDP since

the trough of the crisis in late 2008. It is evident

that Blanchard is completely correct in noting that

the recovery in the major advanced economic regions

is sputtering if not dying. (Data in all charts is

based on IMF's Global Economic Indicators database.)

Output growth in Japan has already turned negative

once again in the most recent quarters, while it is

sluggish in the US and likely to become much worse

in the euro area given the inability to resolve the

internal problems of the eurozone.

Chart

1 >>

(Click to Enlarge)

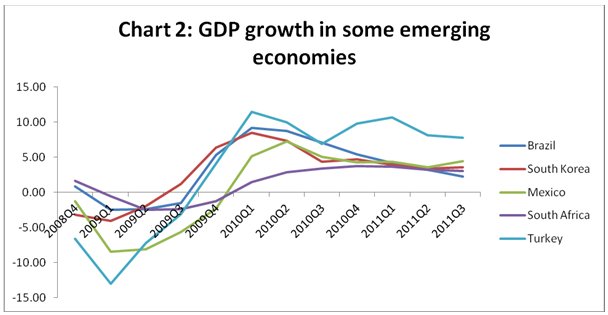

In the past global recession, many developing countries

sufffered quite sharp declines in output but then

the recovery was also faster and more buoyant. Chart

2 shows a sample of emerging market economies (and

does not inlcude China and India about which enough

discussion already exists). Real GDP recovered more

sharply in the economies that had expereinced the

biggest slumps, but despite this, since the middle

of 2010 there has been a deceleration in almost all

of the economies described here.

Chart

2 >>

(Click to Enlarge)

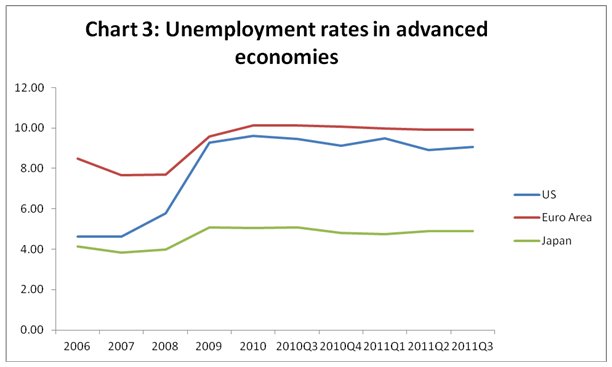

This sluggish recovery or beginning of renewed recession

is of major concern not just in itself, but because

even the period of recovery was already not associated

with much improvement in labour market conditions.

Chart 3 shows that in the three major advanced economic

regions, open unemployment rates increased during

the Great rcession, and since then have remained at

these high levels despite subsequent increases in

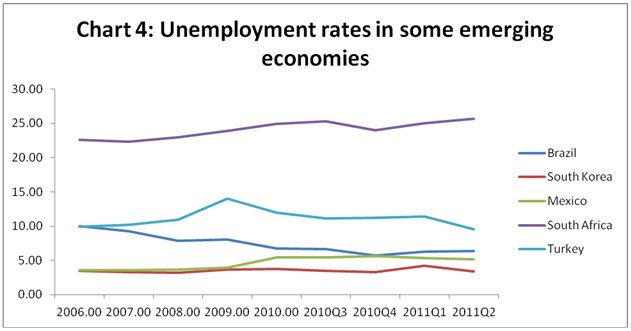

incomes and economic activity. Chart 4 shows that

(other than for Turkey and Brazil) a similar process

was also under way for the emerging economies considered

here.

Chart

3 >>

(Click to Enlarge)

Chart

4 >>

(Click to Enlarge)

A September 2011 report from the ILO to the G20 found

that in the first quarter of 2011, only a handful

of countries (notably, Argentina, Brazil, Turkey and

Indonesia) had absolute employment levels that were

above the levels of the first quarter of 2008, before

the eruption of the global crisis. In some countries

both output and employment were still below their

earlier levels (including the developed world: European

Union, the US and Japan) while in others like South

Africa, output had recovered but employment was still

lower than in early 2008. So the weakening prospects

for the world economy come at a time when labour market

conditions are already very fragile across the world.

This is extremely bad news for the developing world.

Already, it is evident that it is misplaced and even

foolhardy to hope that economic expansion in China,

Brazil, Russia and some other countries will be enough

to compensate for the slowdown in the advanced economies.

In sheer quantitative terms, total incomes and import

demand in these countries simply cannot counterbalance

the falling net demand from US and Europe. But there

are further reasons why developing countries - including

those that are currently being expected to save the

world economy - cannot expect an easy ride in the

coming year themselves.

First, most developing regions are directly affected

by the slowdown in import demand from Europe, and

to a lesser extent the US. For example, manufacturing

exports from developing Asia, particularly China,

are already affected by the slowdown in Europe and

the process is likely to intensify in the coming months.

Second, the reduction in China's exports affects its

own demand, as the complex export production platform

it is the centre of in Asia reduces demand for raw

materials and intermediates. Third, many developing

countries have also been affected adversely by the

sudden and rapid outflow of mobile finance capital,

as banks and other financial institutions book their

profits in emerging markets in order to cover their

losses. This has also been associated with rapid depreciation

of several emerging market currencies, which causes

their import bill for oil and other essential goods

to increase, but not necessarily affecting their exporting

potential in the current climate.

Fourth, there are reasons to be more concerned than

many analysts appear to be, about the immediate prospects

for the Chinese economy. As the housing bubble in

China is pricked and real estate prices fall, this

will have negative multiplier effects on all related

activities in construction and so on. The debt deflation

associated with falling asset prices may also affect

consumption and employment. So there is a serious

internal threat to growth, unless the Chinese government

takes active measures to revive consumption, without

relying on expansion of household debt. In many other

emerging markets, the previous boom was associated

with credit-driven bubbles, and as these are burst,

the prospects for economic expansion will similarly

be affected.

So there are good reasons for Blanchard of the IMF

and others to be gloomy about global economic prospects.

However, unless they and others who have real influence

on economic policy making across the world argue for

a real change in both economic paradigm and current

strategy, things are unlikely to look up in the coming

year.

*

Note: This article

was originally published on 26 December, 2011, in

the Business Line, and is available at:

http://www.thehindubusinessline.com/opinion

/columns/c-p-chandrasekhar/article2749931.ece?

homepage=true