| |

|

|

|

|

Another

Looming Food Crisis* |

| |

| Jul

25th 2012, C.P. Chandrasekhar and Jayati Ghosh |

|

Once

again food prices have reached exorbitant levels in

world trade, surpassing previous peaks and creating

fears of another major global food crisis of massive

proportions. What is particularly shocking this time

around is how little has been learned from the last

crisis just a few years ago, and how criminally slow

the international community and national governments

have been to put in place measures that would prevent

a recurrence of these crazy fluctuations in prices.

It is not just that public memory is short - the more

worrying feature is the denial on the part of policy

makers about at least some of the important factors

that have caused these dramatic price fluctuations;

and the associated and continued refusal to take measures

that will address the problem. As the last round of

food crisis builds up once again and threatens the

lives and material conditions of millions of people

across the world, it is imperative to take a close

and hard look at the evidence on global food prices

and their determinants.

One major problem that prevents clarity of understanding

on this matter is the persistent belief that prices

in global food markets are still fundamentally determined

by changes in real demand and supply. There is no

doubt that medium to long term trends are drive by

this, and that the expectations that drive speculative

behaviour in food markets are also deeply influenced

by perceptions about changes in real demand and supply.

But the pattern of price behaviour in global food

markets in the past few years, and particularly the

volatility in prices that can be observed, bears much

less relation to actual supply and demand shocks,

and much more to activity spurred by expectations

about prices.

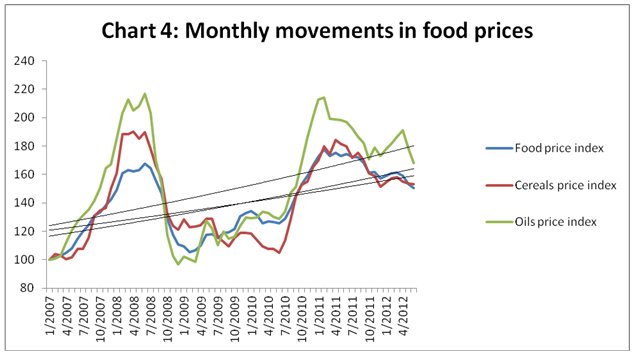

Chart

1 >>

(Click to Enlarge)

Chart

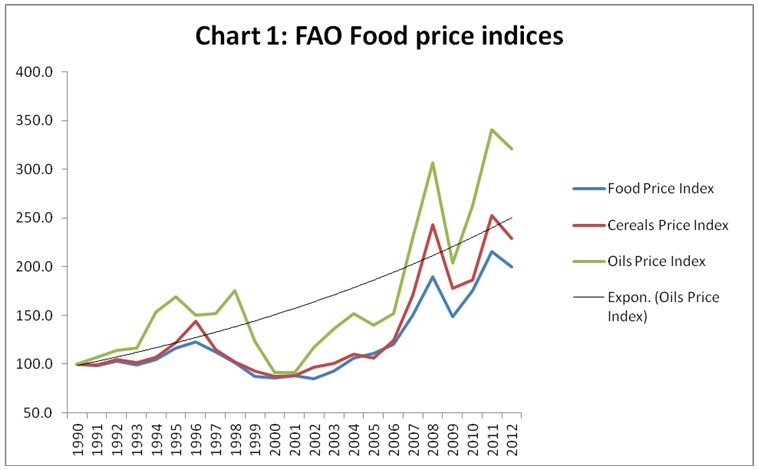

1 shows the behaviour of global food prices indices

since 1990. The underlying trend for the aggregate food

price index is definitely rising, and this is also true

for cereals and edible oils (albeit to a lesser extent).

It is widely accepted that the long years of policy

neglect of agriculture and the agrarian crisis that

affected many developing countries from about the mid

1990s must have had some impact in not enabling food

supply to keep pace with the rising demand that is also

widely perceived to have resulted from the rapid income

growth of some countries with large populations.

However, this conventional interpretation of the food

price increase becomes less convincing when the period

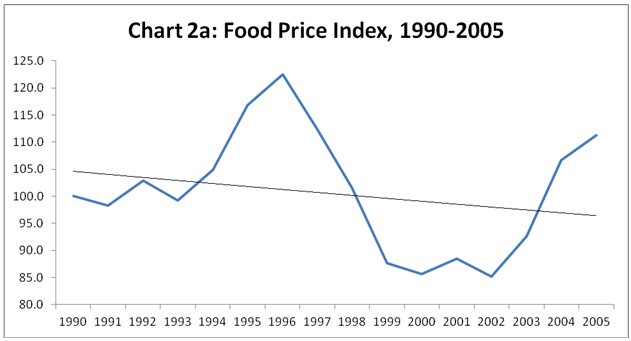

is broken down into sub periods. Charts 2a and 2b show

that the period from 1990 to 2005 was quite different

from the subsequent period in terms of food price changes.

In the first period shown in Chart 2a there was some

volatility to be sure, but the overall price trend over

the period was if anything slightly downward. This is

despite the same features described earlier - supply

side issues like agrarian crisis in the developing world

and insufficient agricultural investment as well as

supposed demand side forces like more food demand stemming

from rising incomes in low or middle incomes countries

- being just as marked in that period, especially the

later part of it.

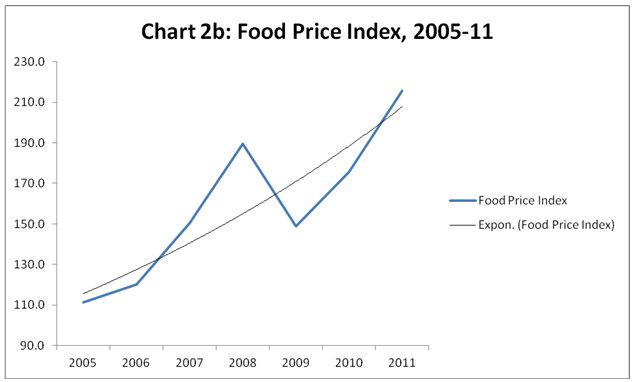

In fact, the real change in prices comes after 2005,

as prices zoom upwards on a volatile path around a rapidly

rising trend. Obviously something much more was at work

in this period than the medium term ''real'' tendencies

that were described above. A further issue of significance

that has affected grain prices is the impact of biofuel

subsidies in the US and EU, which have diverted both

acreage and maize production towards ethanol. Since

these subsidies became large only from 2003 onwards,

it is to be expected that the impact on grain prices

would be felt after this.

Chart

2a >>

(Click to Enlarge)

Chart

2b >>

(Click to Enlarge)

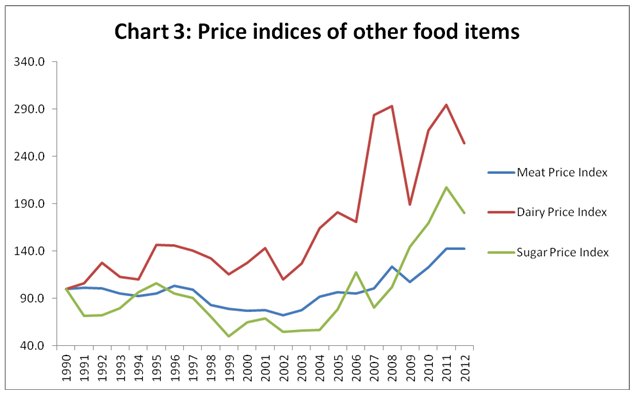

Such a pattern has also prevailed for prices of other

food commodities, as evident from Chart 3. In the medium

terms dairy prices have shown the largest increases,

but more recently the big spike has come in sugar prices.

Chart

3 >>

(Click to Enlarge)

In previous issues of MacroScan, we have elaborated

on the newer forces that have affected price formation

in global food markets, in particular the involvement

of financial players in commodity futures markets, such

that food markets became more and more like other financial

asset markets, plagued with the same problems of asymmetric

information, herd behaviour and extreme volatility.

It was shown to have affected the rapid rise and then

fall of commodity prices in the period 2007-09, as financial

agents first moved to and then away from commodity derivatives

during the run up to and eruption of the global financial

crisis.

But in the more recent period things have got even more

complicated. Certainly it remains the case that financial

activity in commodity futures markets remains strong

and this plays a role in the price movements. And therefore

there is obviously a strong case to be made for bringing

all commodity trading onto regulated exchanges, restricting

the role of purely financial players and enforcing strict

position limits and other such measures.

The measures that have been implemented thus far are

unfortunately halting and inadequate even in the US

(which currently has the strongest such regulations

with respect to commodity markets among advanced countries

because of the Dodd-Frank Law). This has meant that

in the context of very low interest rates and few other

avenues of profitable financial investment, the incentives

for private players continue to be loaded in favour

of such speculation that can dramatically affect global

prices of these essential items.

Even so, it is increasingly simplistic to suggest that

this is all that is going on and that financial regulation

of the kind noted above would be enough to curtail speculative

activity in such markets. This is because large commodity

traders themselves now engage more and more in what

is essentially speculative activity, betting on changes

in prices in order to benefit from these movements even

beyond their requirements of the commodities for ''real''

purposes. The line between purchases of futures contracts

for hedging or speculative purposes is now almost impossible

to draw, especially as large agribusiness and commodity

trading corporations have discovered that there is a

lot of money to be made from purely financial dealings.

This obviously makes the problem of fixing the detail

in financial regulation even more complex, but it also

raises the issue of ensuring that the expectations that

are driving such markets are controlled more effectively.

Obviously, addressing issues of global supply - particularly

through ensuring the greater viability of small scale

production in the developing world - is of critical

importance in this.

Chart

4 >>

(Click to Enlarge)

However,

the sheer volatility of recent price changes around

this increasing trend (as evident from Chart 4)

suggests that even addressing supply issues may

not be enough. A related but slightly different

issue relates to the role of information and the

nature of its spread in what are essentially very

opaque global markets. This can be illustrated with

reference to food grain markets, and particularly

the global wheat market. Wheat is widely seen as

the most significant traded grain and the role of

futures contracts in this market (particularly through

the Chicago Board of Trade) is well-developed.

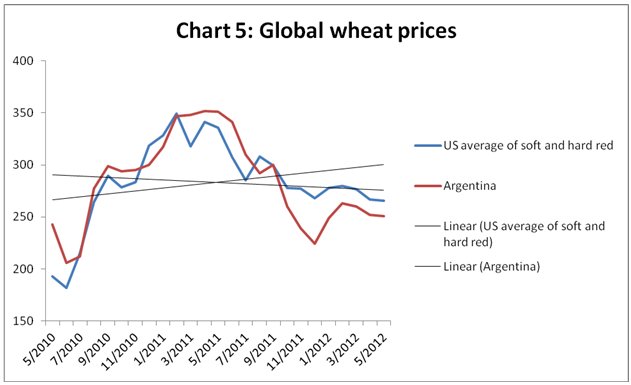

In the past two years, wheat prices have shown the

highest volatility in terms of monthly price changes.

Chart 5 shows how prices of US wheat nearly doubled

in just six months, between June and December 2010,

then fell again until early 2011 and then rose once

more.

Chart

5 >>

(Click to Enlarge)

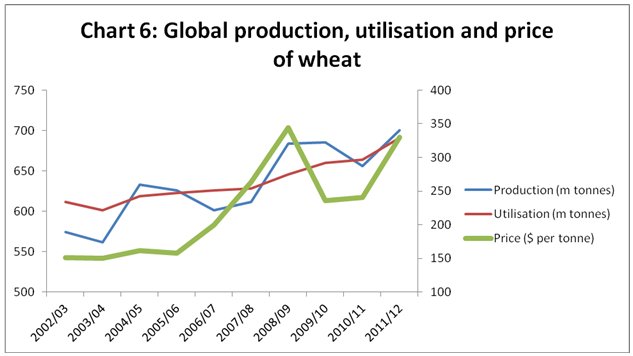

In

terms of ''real'' forces of demand and supply, however,

the global wheat market has been remarkably stable

in the past decade. Chart 6 tracks the behaviour

of aggregate global production and ''utilisation'',

which can be taken as a proxy for demand, according

to FAO data. In the entire period shown in this

chart, both production and utilisation have increased

at average rates of around 2 per cent, and indeed

the rate of increase of production has been slightly

faster than that of utilisation overall.

Clearly, the price changes have borne little relationship

to these two forces. In fact, global wheat prices

appear to have risen in years when supply (production)

was higher, often significantly higher, than demand.

Chart

6 >>

(Click to Enlarge)

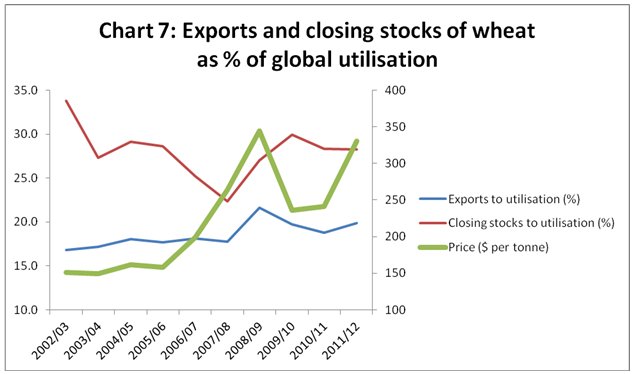

Chart

7 >>

(Click to Enlarge)

Chart

7 suggests that the price changes in the wheat market

have also had little to do with closing stocks of

the same or previous period, while exports have

sometimes (but not always) responded to higher prices.

Of course, it needs to be noted that data on stock

holding is notoriously unreliable. FAO relies on

data from governments on their stock levels, but

some governments do not reveal these data (such

as China). Possibly more significantly, there are

no data on private corporate stock holding, and

given the size and spread of multinational companies

dealing in grain, this can also be substantial.

So if it is not actual changes in demand and supply

that explain the price volatility, what is going

on? One possibility worth considering is the considerable

role played by rumour, and therefore by the media,

in altering expectations. For example, in the period

from June 2010 when global prices rose sharply,

the media were full of reports about the failure

of the harvest in Ukraine, a major wheat exporter,

and then replete with doomsday predictions following

on the export ban in Russia. These certainly drove

up price expectations and pushed up prices in the

futures market very quickly.

Subsequently, FAO data reveal that global production

of wheat had actually increased in this period,

largely because of expanded wheat output in Asia.

But the period of sharply rising prices, while it

involved many losers including the poor throughout

the developing world, also had some winners. The

large commodity trader Glencore went for a public

stock offering in early 2011, and when doing so

it revealed that it had doubled its profits the

previous years, largely because of gains made in

the wheat trade.

Something similar is happening at present - the

media are awash with scaremongering stories about

the drought in the US and other factors affecting

global grain supply. Already wheat prices in the

first half of July 2012 have increased by more than

22 per cent, even though FAP estimates still suggest

that globally this will be a bumper year with a

record wheat output. Once again poor people will

suffer because of higher food prices, without even

realising that private profiteering at different

levels is generating that disastrous tendency in

global prices.

*

This article was originally published in the Business

Line print edition dated 24th July, 2012.

|

| |

|

Print

this Page |

|

|

|

|